BMW 2005 Annual Report Download - page 102

Download and view the complete annual report

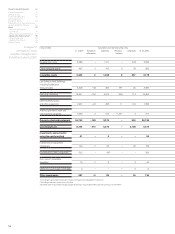

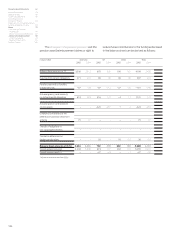

Please find page 102 of the 2005 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Capital reserves

The capital reserves comprise additional paid in capi-

tal

on the issue of shares and remained unchanged

at euro1,971 million.

Revenue reserves

Revenue reserves comprise the post-acquisition

and non-distributed earnings of consolidated group

companies. In addition, revenue reserves include

both positive and negative goodwill arising on the

consolidation of group companies prior to 31 De-

cember 1994.

Revenue reserves increased during the year by

12.5% to euro 16,351 million. They were increased

in 2005 by the amount of the net profit for the year

of euro 2,239 million and were reduced by the

payment of the dividend for 2004 amounting to

euro 419 million.

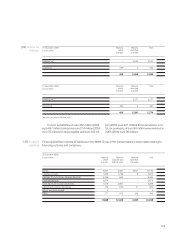

The unappropriated profit of BMW AG of euro

424 million for 2005 will be proposed to the Annual

General Meeting for distribution. As in the previous

year, this will not give rise to a tax credit relating to

the corporation tax system applicable until 2001,

since, following the enactment of the Tax Preference

Reduction Act on 16 May 2003, the tax benefit on

distributed profits was suspended until the end

of 2005. Adjusted in the light of new information,

tax reduction benefits of euro 168 million (2004:

disclosed as euro133 million) which result from the

previous corporation tax system, can be

realised

in specific annual amounts during the period

from

2006 to 2019. On the basis of the proposed dividend,

a tax reduction benefit of euro 12 million arises for

2006. In the light of the maximum amount regulations

which apply for each dividend year, the total amount

will not be fully utilised before 2019.

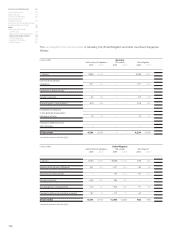

Accumulated other equity

Accumulated other equity consists of all amounts

recognised directly in equity resulting from the

translation of the financial statements of foreign

subsidiaries, the effects of recognising changes in

the fair value of financial instruments directly in

equity, and actuarial gains and losses relating to de-

fined benefit pension plans and similar obligations.

At 31 December 2005, accumulated other equity

is increased by deferred taxes recognised directly

in equity amounting to euro 727 million (2004:

decreased by deferred taxes of euro 172 million*).

Minority interest

As a result of the insignificance of the minority share-

holders’ interest in the equity of the group’s sub-

sidiaries, minority interest is not reported separately.

Minority interest in the share capital of subsidi-

aries amounts to euro 0.188 million (2004: euro

0.312 million).

Of this amount, euro 0.187 million

(2004: euro

0.311 million) relates to the minority

shareholder Euro

Lloyd Reisebüro GmbH, Cologne,

and euro 0.001million (unchanged from the previous

year) relates to the

minority shareholder Nord-

deutsche Landesbank

Girozentrale, Braunschweig.

101

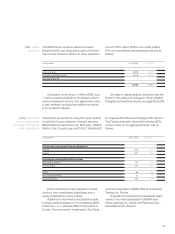

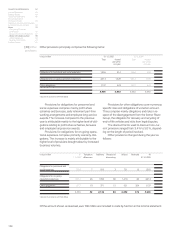

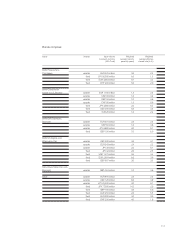

[32]Pension provisions The BMW Group has elected to adopt early the new

optional accounting policy of recognising actuarial

gains and losses directly in equity and has applied

the new treatment in the Group financial statements

at 31 December 2005. Under the new rules, actuarial

gains and losses will no longer be recognised in

profit or loss over time.

Pension provisions are recognised as a result of

commitments to pay future vested pension benefits

and current pensions to present and former employ-

ees of the BMW Group and their dependants. De-

pending on the legal, economic and tax circum-

stances prevailing in each country, various pension

plans are used, based generally on the length of

service and salary of employees. Due to similarity

of nature, the obligations of BMW Group companies

in the U.S. and of BMW (South Africa) (Pty) Ltd.,

Pretoria, for post-employment medical care are

also disclosed as pension provisions. The provision

for these pension-like obligations amounts to euro

*adjusted in accordance with Note [8] (b)