BMW 2005 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2005 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205

|

|

117

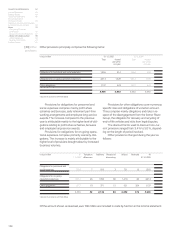

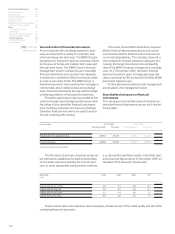

The nominal amounts of derivative financial

instruments correspond to the purchase or sale

amounts or contract values of the underlying trans-

actions. The nominal amounts, fair values (and also

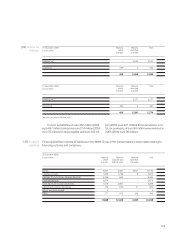

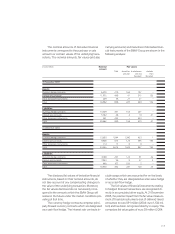

The disclosed fair values of derivative financial

instruments, based on their nominal amounts, do

not take account of any compensating changes in

the value of the underlying transaction. Moreover,

the fair values disclosed do not necessarily corre-

spond to the amounts which the BMW Group will

realise in the future under the market conditions pre-

vailing at that time.

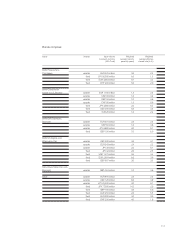

The currency hedge contracts comprise

princi-

pally forward currency contracts which are designated

as a cash flow hedge. The interest rate contracts in-

carrying amounts) and maturities of derivative finan-

cial instruments of the BMW Group are shown in the

following analysis:

clude swaps which are accounted for on the basis

of whether they are designated as a fair value hedge

or as a cash flow hedge.

The fair values of financial instruments relating

to hedged forecast transactions are recognised di-

rectly in accumulated other equity. At 31 December

2005, the positive impact from the fair value measure-

ment

of financial instruments (net of deferred taxes)

amounted to euro 591 million (2004: euro 1,134 mil-

lion) and has been recognised directly in equity. This

comprises fair value gains of euro 29 million (2004:

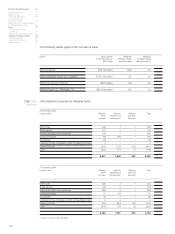

in euro million Nominal Fair values

amount

Total due within due between due later

one year one and than

five years five years

31 December 2005

Assets

Currency hedge contracts 6,378 270 163 107 –

Interest rate contracts 11,975 488 41 315 132

Other derivative instruments 209 48 21 27 –

Total 18,562 806 225 449 132

Liabilities

Currency hedge contracts 14,509 361 154 207 –

Interest rate contracts 5,792 36 2 13 21

Other derivative instruments 561 453 – 453 –

Total 20,862 850 156 673 21

31 December 2004

Assets

Currency hedge contracts 13,833 1,844 1,390 453 1

Interest rate contracts 9,608 813 124 495 194

Other derivative instruments 114 17 8 9 –

Total 23,555 2,674 1,522 957 195

Liabilities

Currency hedge contracts 3,189 237 124 91 22

Interest rate contracts 7,043 38 8 27 3

Other derivative instruments 646 107 105 2 –

Total 10,878 382 237 120 25