BMW 2005 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2005 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.72

The equity of subsidiaries is consolidated in accor-

dance with IFRS 3 (Business Combinations). IFRS 3

requires that all business combinations are accounted

for using the purchase method, whereby identifiable

assets and liabilities acquired are measured initially

at their fair value. The excess of the Group’s interest

in the net fair value of the identifiable assets and lia-

bilities acquired over cost is recognised as goodwill

and is subjected to a regular review for possible

impairment. Goodwill of euro 91million which arose

prior to 1 January 1995 remains netted against re-

serves. In the event of impairment and deconsolida-

tion, goodwill that has been deducted from equity is

dealt with directly in equity in accordance with the

requirements of IFRS 3.80.

The financial statements of consolidated companies

which are drawn up in a foreign currency are trans-

lated using the functional currency concept (IAS 21:

The Effects of Changes in Foreign Exchange Rates)

and the modified closing rate method. The functional

currency of a subsidiary is determined on the basis

of the primary economic environment in which it

operates and corresponds therefore to the relevant

local currency. Income and expenses of foreign sub-

sidiaries are translated in the Group financial state-

ments at the average exchange rate for the year, and

assets and liabilities are translated at the closing

rate. Exchange differences arising from the trans-

lation of shareholders’ equity are offset directly

against accumulated other equity. Exchange differ-

ences arising from the use of different exchange

rates to translate the income statement are also

offset directly against accumulated other equity.

Foreign currency receivables and payables in

the single entity accounts of BMW AG and sub-

sidiaries are recorded, at the date of the transaction,

at cost. Exchange gains and losses computed at

the balance sheet date are recognised as income or

expense.

Receivables, liabilities, provisions, income and

expenses and profits between consolidated com-

panies (intragroup profits) are eliminated on con-

solidation.

Under the equity method, investments are

measured at the group’s share of equity taking

account of fair value adjustments on acquisition,

based on the group’s shareholding. Any difference

between the cost of investment and the group’s

share of equity is accounted for in accordance with

the purchase method. Investments in other com-

panies are accounted for using the equity method,

when significant influence can be exercised (IAS 28

Investments in Associates). This is normally the case

when voting rights of between 20% and 50% are

held (associated companies).

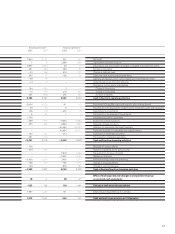

[4]Consolidation

principles

[5]Foreign

currency translation

BMW Automotive (Ireland) Ltd., Dublin, Parkhaus

Oberwiesenfeld GmbH, Munich, Gesellschaft für

Vermietung und Verwaltung von Kraftfahrzeugen

mbH, Munich, entory AG, Ettlingen, Silverstroke AG,

Ettlingen, entory S.A. Luxembourg, Luxembourg,

and Bavaria Reinsurance Malta Ltd., Valletta, have all

been consolidated for the first time.

No subsidiaries were deconsolidated during the

year under report.

The group reporting entity also changed by

com-

parison to the previous year as a result of the first-

time consolidation of two special purpose entities

and the deconsolidation of three special purpose

entities.

The changes in the composition of the Group

do not have a material impact on the assets, liabili-

ties, financial position and earnings of the Group.

[3]Changes in

the reporting entity

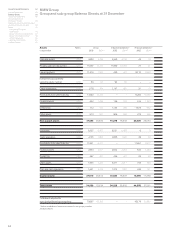

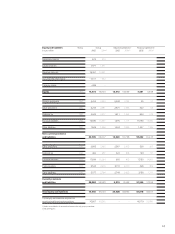

Group Financial Statements 62

Income Statements 63

Balance Sheets 64

Cash Flow Statements 66

Group Statement of

Changes in Equity 68

Statement of Income and Expenses

recognised directly in Equity 69

Notes 70

--Accounting Principles

and Policies 70

--Notes to the Income Statement 81

--Notes to the balance sheet 90

--Other Disclosures 114

--Segment Information 121

Auditors’ Report 125