BMW 2005 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2005 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.8

Group Management Report 8

A Review of the Financial Year 8

The General Economic Environment 11

Review of operations 15

BMW Stock in 2005 38

Financial Analysis 41

--Internal Management System 41

--Earnings performance 42

--Financial position 45

--Net assets position 46

--Subsequent events report 49

--Value added statement 49

--Key performance figures 51

--Comments on BMW AG 52

Risk Management 56

Outlook 60

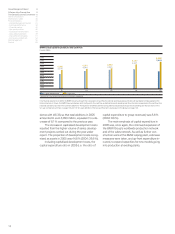

BMW Group successful despite difficult

environment

The BMW Group continued to perform successfully

in 2005 despite a difficult environment. It further

extended its lead in the premium segments of the

international automobile markets by recording a

sharp rise in its car sales volume. Particular chal-

lenges arose in the year under report as a result of

the co-occurrence of adverse currency factors,

above-average raw material prices and intense com-

petition on the international car markets. The BMW

Group was, however, once again able to prove its

operating strength. As a result of the sharp increase

in car sales and on-going efficiency improvement

measures, the negative impact of these external fac-

tors was almost completely offset by the year-end.

Profit before tax, at euro 3,287 million, was 8.3% be-

low the record level achieved in the previous year.

The adverse effects have particularly affected

the Automobiles segment. Compared to the record

result recorded in the previous year, the segment’s

profit before tax fell by 5.9% to euro 2,976 million.

After the temporary slow-down in the previous

year, the Motorcycles segment returned to the

growth course set in previous years and recorded

a sharp increase in sales volume. Segment profit in

2005 rose by 93.5% to euro 60 million.

Strong growth by the Financial Services seg-

ment again provided the basis for a very pleasing

improvement in earnings. At euro 605 million, seg-

ment profit surpassed the previous year’s record

result by 17.5%.

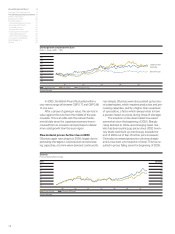

In addition to the impact from adverse operating

factors, group earnings in 2005 were also affected

by fair value gains and losses. The fair value loss

on the exchangeable bond option relating to the

BMW Group investment in Rolls-Royce plc, London,

resulted in an additional expense of euro 308 million

being recorded in 2005 compared to the previous

year.

Positive tax factors in 2005 reduced the Group’s

tax expense. The BMW Group reports a net profit

for the year of euro 2,239 million, almost matching

the previous year’s high level (– 0.1%).

Increased dividend proposed

The Board of Management and Supervisory Board

propose to the Annual General Meeting to use the

unappropriated profit available for distribution in

BMW AG, amounting to euro 424 million, to pay a

dividend of euro 0.64 for each share of common

stock (2004: euro 0.62) and euro 0.66 for each share

of preferred stock (2004: euro 0.64), each with a

nominal value of euro 1.

Programme to buy back shares of

common stock

At the Annual General Meeting of Bayerische

Motoren Werke Aktiengesellschaft on 12 May 2005,

the shareholders authorised the Board of Manage-

ment to acquire treasury shares via the stock ex-

change, up to a maximum of 10% of the share

capital issued at the date of the resolution and to

withdraw these shares from circulation without any

further resolution by the Annual General Meeting.

In conjunction with this authorisation, the Board of

Management of BMW AG resolved on 20 Septem-

ber 2005 to put a programme in place to buy back

shares via the stock exchange. Up to 20,232,722

shares of common stock (i.e. 3% of share capital)

have been acquired under this programme.The

shares have been acquired with the purpose of with-

drawing them from circulation at a later date and

reducing share capital. A total of 13,488,480 shares

of common stock had been acquired by the end of

2005, equivalent to 2% of share capital.The average

Group Management Report

A Review of the Financial Year