BMW 2005 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2005 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.49

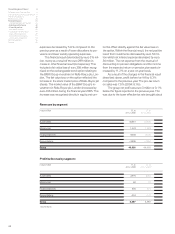

employee-related obligations. By contrast, provisions

for other obligations decreased by 17.4%, mainly

as result of the above-mentioned reversal of a pro-

vision relating to the Rover disengagement. The

reversal is reported within the Reconciliations seg-

ment.

Deferred tax liabilities went up by 10.8% to euro

2,522 million, mainly as result of the higher level of

leased-out products in the USA which are depreci-

ated more quickly for tax purposes than for IFRS

purposes. Currency factors also played a role.

Financial liabilities increased by 12.1% to euro

34,668 million. Within financial liabilities, bonds in-

creased by 21.8% to euro 15,162 million, mainly as

a result of the higher volume of the medium term

note programme and of other bonds. Liabilities from

customer deposits (banking) also increased sharply,

rising by 25.3% to euro 6,392 million.

Trade payables amounted to euro 3,544 million

and were thus 5.0% higher than one year earlier.

Other liabilities of euro 5,236million were

26.4%

above their level at the end of the previous year.

Within other liabilities, deferred income relating to

service and repair agreements increased sharply.

Subsequent events report

On 1 January 2006, the BMW Group acquired a

majority interest in Sauber Holding AG, Vaduz.

In conjunction with the share buy-back pro-

gramme,

the BMW Group had, by 21 February

2006, acquired shares of common stock equivalent

to 3% of the share capital of BMW AG.

In conjunction with the exchangeable bond

re-

lating to the BMW Group’s investment in Rolls-Royce

plc, London, declared and notified exchange re-

quests had been received by the BMW Group from

investors by 21 February 2006 corresponding to

approximately 42% of the exchangeable bond.

Servicing the exchange requests by the delivery

of shares would have a positive effect on the BMW

Group’s earnings in 2006.

Apart from these items, no events have occurred

after the balance sheet date which could have a

major impact on the earnings performance, financial

position and nets assets of the BMW Group.

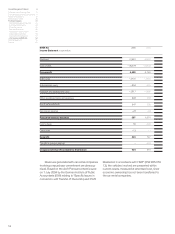

Value added statement

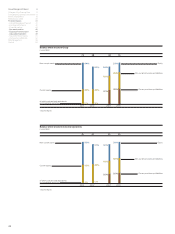

The value added statement shows the value of work

performed less the value of work bought in by the

BMW Group during the financial year. Depreciation

and amortisation, cost of materials and other ex-

penses are treated as bought-in costs in the value

added calculation. The allocation statement applies

value added to each of the participants involved in

the value added process. It should be noted that

the gross value added treats depreciation as a com-

ponent of value added which, in the allocation state-

ment, is treated as internal financing.

Net valued added by the BMW Group in 2005

increased by 2.2% to euro 12,486 million. The in-

crease was attributable to the higher level of rev-

enues. The increase in gross valued added, at 5.6%,

was even more pronounced since it is not affected

by

depreciation and amortisation, which were higher

than

in the previous year.

The bulk of the net value added (58.5%) is

applied to employees, 2.5% up in absolute terms

compared to the previous year. The amount applied

to providers of funds also went up, rising by 27.6%

to give a proportion of 10.9%. The government/

public sector (including deferred tax liabilities of the

Group) accounted for 12.7%. The proportion of net

value added applied to shareholders, at 3.4%, was

similar to the previous year’s level. The remaining

proportion of net value added (14.5%) will be retained

in the Group to finance future operations. In ab-

solute terms, this is 0.4% lower than in the pre-

vious year.