BMW 2005 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2005 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

102

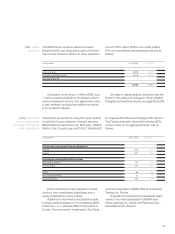

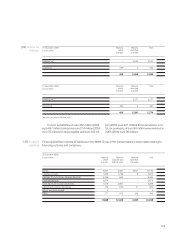

43 million (2004: euro 29 million) and is measured,

similar to pension obligations, in accordance with

IAS 19. In the case of post-employment medical care,

it is assumed that the costs will increase on a long-

term basis by 6% p.a. (2004: 7%). The expense for

medical care costs in the financial year 2005 amounted

to euro 8 million (2004: euro 5 million).

Post-employment benefit plans are classified as

either defined contribution or defined benefit plans.

Under defined contribution plans, an enterprise pays

fixed contributions into a separate entity or fund and

does not assume any other obligations. The total

pension expense for all defined contribution plans

of the BMW Group amounted to euro 400 million

(2004: euro 383 million).This includes employer con-

tributions paid to state pension insurance schemes

amounting to euro 381million (2004:euro 369million).

Under defined benefit plans, the enterprise is

required to pay the benefits granted to present and

past employees. Defined benefit plans may be funded

or unfunded, the latter sometimes financed by means

of accounting provisions. Most of the pension com-

mitments of the BMW Group in Germany relate to

BMW AG, whose pension plans, like all those of all of

the BMW Group’s German subsidiaries, are unfunded

and financed by means of accounting provisions. In

addition, a deferred remuneration retirement scheme

is in place which is funded by employee contribu-

tions. The main funded plans of the BMW Group are

in the United Kingdom, the USA, Switzerland, the

Netherlands, Belgium and Japan.

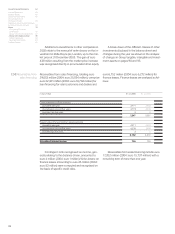

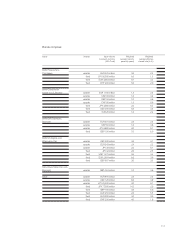

Pension obligations are computed on an actu-

arial basis at the level of the defined benefit obliga-

tion.This computation requires the use of estimates.

The main assumptions, in addition to life expectan-

cy, depend on the economic situation in each partic-

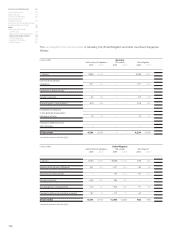

ular country. The following weighted average values

are used in the United Kingdom (UK) and in the other

countries:

The salary level trend refers to the expected

rate of salary increase which is estimated annually

depending on inflation and the period of service of

employees with the Group.

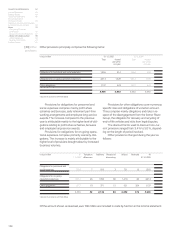

In the case of funded plans, the defined benefit

obligation is offset against plan assets measured

at their fair value. Where the plan assets exceed the

pension obligations and the enterprise has a right

of reimbursement or a right to reduce future contri-

butions, the surplus amount is recognised in accor-

dance with IAS 19 as an asset under miscellaneous

assets. A liability is recognised under pension pro-

visions in the case of funded plans where the pen-

sion expense exceeds the contributions paid to the

fund.

Actuarial gains or losses may result from in-

creases or decreases in either the present value of

the defined benefit obligation or in the fair value of

the plan assets. Causes of actuarial gains or losses

include the effect of changes in the measurement

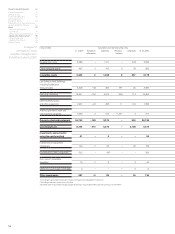

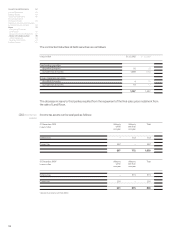

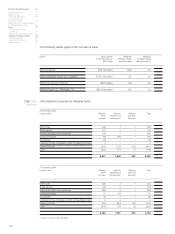

in % Germany UK Other

31 December 2005 2004 2005 2004 2005 2004

Discount rate 4.25 4.75 4.72 5.25 5.28 5.31

Salary level trend 3.25 3.25 3.86 3.86 2.62 3.16

Pension level trend 1.75 1.75 2.83 2.74 1.89 1.67

Group Financial Statements 62

Income Statements 63

Balance Sheets 64

Cash Flow Statements 66

Group Statement of

Changes in Equity 68

Statement of Income and Expenses

recognised directly in Equity 69

Notes 70

--Accounting Principles

and Policies 70

--Notes to the Income Statement 81

--Notes to the balance sheet 90

--Other Disclosures 114

--Segment Information 121

Auditors’ Report 125