BMW 2005 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2005 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205

|

|

85

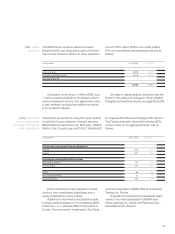

The reduction in the current tax expense is

mainly attributable to tax reimbursements relating to

prior years.

The increase in the deferred tax expense re-

sults from the higher usage of deferred assets as a

result of the utilisation of tax losses, primarily outside

Germany.

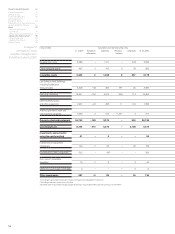

Deferred taxes are computed using tax rates

based on laws already enacted in the various tax

jurisdictions or using rates that are expected to apply

at the date when the amounts are paid or recovered.

A corporation tax rate of 25.0% applies in Germany.

After taking account of the average multiplier rate

(Hebesatz) of 412% for municipal trade tax and the

solidarity charge of 5.5%, the overall tax rate for BMW

companies in Germany is unchanged at 38.9%.The

tax rates for companies outside Germany range from

10.0% to 40.7% (2004: 10.0% to 41.7%). Changes

in tax rates in foreign tax jurisdictions did not have a

significant impact on deferred tax income or expense

in 2005 (2004: reduction of deferred tax expense by

euro 4 million).

Deferred taxes were not recognised on retained

profits of euro 12,413 million (2004: euro 10,541

mil-

lion), as it is intended to invest these profits to main-

tain

and expand the business volume of the relevant

companies. A computation was not made of the

potential impact of income taxes on the grounds of

disproportionate expense.

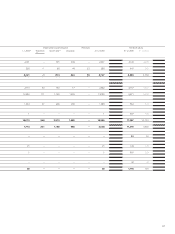

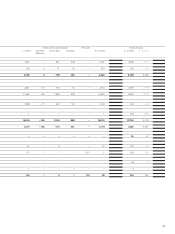

Taxes on income comprise the following:

[15]Income taxes

in euro million 2005 2004*

Current tax expense 437 841

Deferred tax expense 611 500

1,048 1,341

*adjusted in accordance with Note [8] (b)