BMW 2005 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2005 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

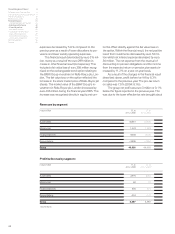

operations (euro 1,809 million) and receivables from

financial operations (euro 3,236 million) less the

financial liabilities of industrial operations. Excluding

interest and currency derivatives, the latter amounted

to euro 1,540 million.

Net assets position

Change in presentation of the Group balance

sheet

For the purposes of preparing its Group financial

statements, the BMW Group has applied revised

IAS 1 (Presentation of Financial Statements),

amended as part of the Improvement Project, at

1 January 2005. This Standard requires the bal-

ance sheet to be classified on the basis of the

maturity of assets and liabilities (current/non-cur-

rent distinction) and, as already reported in quar-

terly reports during 2005, has resulted in a change

in presentation of the Group balance sheet (see

also Note [8] (a)).

The balance sheet total went up by euro 6,932

million or 10.2% to euro 74,566 million. The main

factors behind the increase on the assets side

were the higher level of leased products (+51.6%),

intangible assets (+22.2%) and receivables from

sales financing (+16.0%). On the equity and liabili-

ties side of the balance sheet, the main increases

related to other liabilities (+26.4%), pension provi-

sions (+24.4%) and financial liabilities (+12.1%).

Currency factors, mainly in connection with the higher

exchange rate of the US dollar against the euro,

in-

creased the balance sheet total by euro 3,526 million.

Excluding the effect of exchange rate fluctuations,

the increase would have been 4.8%.

Intangible assets increased by 22.2% to euro

4,593 million. Within intangible assets, capitalised

development costs went up by 18.6% to euro 4,146

million. Development costs recognised as assets

during the year under report amounted to euro 1,396

million (+24.5%), equivalent to a capitalisation ratio

of 44.8% (2004: 39.8%).The increase in capitalised

development costs resulted from the higher volume

of series development projects carried out in 2005.

Amortisation in intangible assets amounted to euro

745 million (+17.0%).

The carrying amount of property, plant and

equipment increased by 3.4% to euro 11,087 mil-

lion.

The bulk of capital expenditure related to further

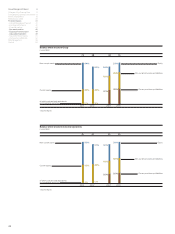

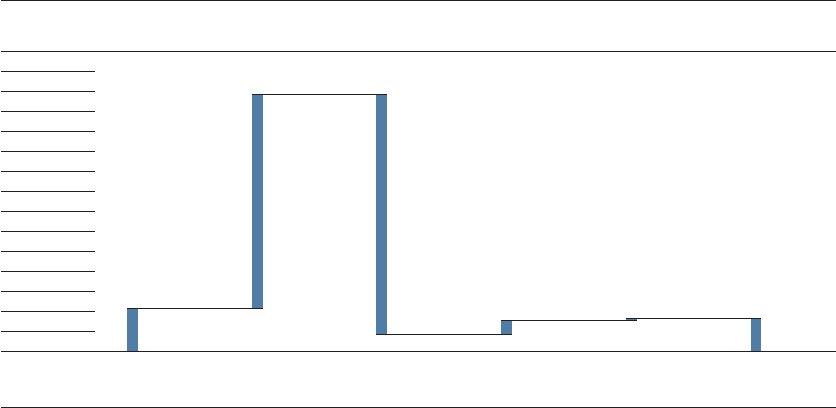

Change in cash and cash equivalents

in euro million

14,000

13,000

12,000

11,000

10,000

9,000

8,000

7,000

6,000

5,000

4,000

3,000

2,000

1,000

Cash and cash

equivalents

31.12. 2004

Cash inflow from

operating activities

Cash outflow from

investing activities

Cash inflow from

financing activities

Currency trans-

lation, changes in

group composition

Cash and cash

equivalents

31.12. 2005

2,128

+ 10,691 – 11,963

+ 699 +66 1,621

Group Management Report 8

A Review of the Financial Year 8

The General Economic Environment 11

Review of operations 15

BMW Stock in 2005 38

Financial Analysis 41

--Internal Management System 41

--Earnings performance 42

--Financial position 45

--Net assets position 46

--Subsequent events report 49

--Value added statement 49

--Key performance figures 51

--Comments on BMW AG 52

Risk Management 56

Outlook 60