BMW 2005 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2005 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.47

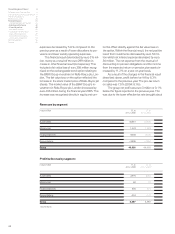

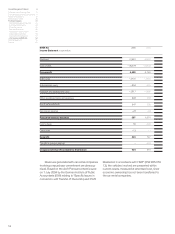

expansion of the worldwide production and sales

networks. Capital expenditure on property, plant and

equipment was euro 2,408 million or 21.8% lower

than in the previous year, mainly as a result of the

effect of special factors in 2004, such as the con-

struction of the new BMW Leipzig plant and invest-

ment

incurred in conjunction with the BMW 3 Series

model

change. Total depreciation and disposals,

in-

cluding currency impact, amounted to euro 2,133 mil-

lion (+3.4%). Balances brought forward for subsid-

iaries being consolidated for the first time amounted

to euro 88 million. Capital expenditure on intangible

assets and property, plant and equipment totalled

euro 3,993 million (– 8.1%), which, as in the previous

year, was financed fully out of cash flow. Capital

expenditure as a percentage of revenues was 8.6%

(2004: 9.8%).

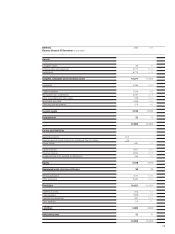

As a result of the growth of business, the total

carrying amount of leased products increased

sharply by 51.6% to euro 11,375 million. Adjusted

for changes in exchange rates, leased products

would have risen by 38.8%.

The carrying amount of other investments in-

creased by 67.3% to euro 1,178 million, mainly as

a result of the fair value gain recognised on the in-

vestment in the engine manufacturer Rolls-Royce

plc, London. The market price of this investment

rose by euro 438 million compared to the previous

year-end. The increase in value of the investment

was recognised directly in accumulated other

equity.

Receivables from sales financing increased by

16.0% to euro 29,053 million due to higher business

volumes. Of this amount, customer and dealer fi-

nancing accounted for euro 22,301 million (+18.7%)

and finance leases accounted for euro 6,752 million

(+7.7%).

Deferred tax assets amounted to euro 772 mil-

lion at the balance sheet date, increasing by euro

257 million as a result of lower valuation allowances

and the new accounting treatment of pension obli-

gations (see Note [8] (b)).

Inventories, at euro 6,527 million, were roughly

at the previous year’s level.Trade receivables went

up by 14.3% compared to their low level at 31 De-

cember 2004.

Financial assets decreased by 42.7% to euro

3,296 million mainly as a result of lower volumes

and the lower fair values of derivative financial instru-

ments.

Liquid funds fell by 6.7% to euro 3,695 million.

The make-up of liquid funds shifted in favour of

marketable securities which were increased by

13.2% compared to one year earlier. Cash and cash

equivalents decreased mainly as a result of the

share buy-back programme.

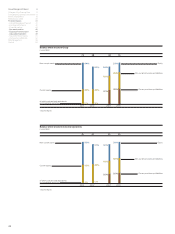

On the equity and liabilities side of the balance

sheet, equity grew by 2.7% to euro 16,973 million.

The group net profit for the year increased equity by

euro 2,239 million, whereas value changes recog-

nised directly in equity reduced it by euro 875 mil-

lion. The latter comprise translation differences, fair

value gains and losses on financial instruments and

available-for-sale securities as well as actuarial gains

and losses. The dividend payment for the financial

year 2004 and the buy-back of shares reduced

equity by a further euro 925 million. The equity ratio

of the BMW Group therefore fell overall by 1.6 per-

centage points to 22.8%.

The equity ratio for industrial operations was

39.1% compared to 41.6% at the end of the pre-

vious year. The equity ratio for financial operations

improved by 0.7 percentage points to 10.4%.

The amount recognised in the balance sheet

for pension obligations increased by 24.4% to euro

5,255 million. As a result of the changed accounting

policy for pension obligations, the amount reported

under pension provisions now corresponds fully to

the defined benefit obligation (DBO). In the case of

pension plans with fund assets, the fair value of fund

assets is offset against the defined benefit obligation.

The increase in pension obligations was attributable

principally to lower discount factors in Germany and

in the United Kingdom and the use of new mortality

tables in Germany.

The higher level of additions to provisions related

mainly to other provisions and was attributable to

the increase in the volume of business and higher