BMW 2005 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2005 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

Exchange rate and commodity prices dominate

mood on stock exchanges

The 2005 stock exchange year was dominated by

the development of the US dollar exchange rate

against the euro and by the continuing high level of

commodity prices.

Over the course of the year, the relationship

between the euro and the US dollar turned in favour

of enterprises exporting into the dollar region. Com-

pared to the exchange rate at the beginning of the

year, the main European currency lost approximately

13% in value against the US dollar. At the end of

the last day of trading in 2005, one euro was worth

US dollar 1.18.

As in the previous year, the prices of important

raw materials went up again, with oil and steel prices

rising particularly steeply.

Despite the adverse impact of higher raw mate-

rial prices, the main stock exchange indices rose

sharply in 2005. Compared to the end of the pre-

vious year, the EUROSTOXX 50 registered a 21.3%

gain in 2005 and the main German index, the DAX,

rose by 27.1%.

The Prime Automobile index also performed

extremely well, closing at 453.24 points and thus

recording a gain of 31.1% over the year.

BMW common stock closed at euro 37.05 on

31 December 2005, giving an 11.6% increase for

the year: the modest gains seen during the course

of the year therefore continued towards the year-

end.

By contrast, BMW preferred stock, which closed

at euro 33.00 on 31 December 2005, rose by 33.1%

and therefore performed better than the market as

a whole.

With a market capitalisation of almost euro 25 bil-

lion,

the BMW Group lies in fifth place amongst the

world’s car manufacturers.

As in the past, the investor relations team pro-

vided a full range of services to investors with a long-

term interest in the BMW Group. Activities included

personal discussions and group events in the rele-

vant financial centres of the world and at BMW AG’s

head office in Munich. These activities will be ex-

panded further in 2006.

Programme to buy back shares of

common stock

At the Annual General Meeting of Bayerische

Motoren Werke Aktiengesellschaft (BMW AG)on

12 May 2005, the shareholders authorised the

Board of Management to acquire treasury shares

via the stock exchange, up to a maximum of 10% of

the share capital in place at the date of the resolu-

tion and to withdraw these shares from circulation

without any further resolution by the Annual General

Meeting. The buy-back authorisation is valid until

11 November 2006. The consideration paid by the

Company per share (excluding transaction costs)

may not be more than 10% above or below the mar-

ket price on the date of trading as determined by

the opening auction in the Xetra trading system.

Following on from the authorisation given by

the shareholders at the Annual General Meeting on

12 May 2005, the Board of Management of BMW AG

resolved on 20 September 2005 to put a programme

BMW Stock in 2005

Group Management Report 8

A Review of the Financial Year 8

The General Economic Environment 11

Review of operations 15

BMW Stock in 2005 38

Financial Analysis 41

--Internal Management System 41

--Earnings performance 42

--Financial position 45

--Net assets position 46

--Subsequent events report 49

--Value added statement 49

--Key performance figures 51

--Comments on BMW AG 52

Risk Management 56

Outlook 60

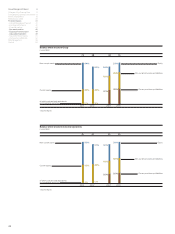

Development of BMW stock compared to stock exchange indices

(Index: 31.12.1995 = 100)

450

400

350

300

250

200

150

100

50

96 97 98 99 00 01 02 03 04 05

BMW preferred stock

BMW preferred stock

BMW common stock

DAX

Prime Automobile

BMW common stock Prime Automobile DAX