BMW 2005 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2005 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205

|

|

81

euro 983 million to euro 16,534 million. Pension

provisions increased by euro 1,521 million to euro

4,224 million. Deferred tax assets increased by

euro 219 million to euro 515 million, whilst deferred

tax liabilities decreased by euro 319 million to euro

2,277 million.

If the Group financial statements had been pre-

pared using the previous method, the impact would

have been as follows:

Profit before tax in the income statement

would be euro 44million lower. Net of a deferred tax

expense of euro 16 million, the net profit for 2005

would have been euro 28 million lower.

In the balance sheet at 31 December 2005,

equity would have been euro 1,404 million higher

and pension provisions euro 2,214 million lower.

Deferred tax assets would be euro 254 million lower

and deferred tax liabilities euro 556 million higher.

Earnings per share of common stock for the

financial year 2004 improved by euro 0.03 to euro

3.33 as a result of the changes; earnings per share

of preferred stock improved by the same amount

to euro 3.35. For the financial year 2005, the adjust-

ment to earnings per share would be euro 0.04.

As a result, using the previous accounting policy,

earnings per share of common and preferred stock

would be euro 3.29 and euro 3.31 respectively.

Attention is drawn to the adjustments made to

prior year figures by the use of footnotes.

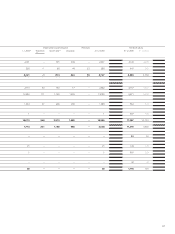

Revenues by activity comprise the following:

in euro million 2005 2004

[9]Revenues

Group revenues include revenues of euro

8,073 million (2004: euro 6,829 million) relating to

financial services business.

An analysis of revenues by business segment

and geographical region is shown in the segment

information on pages 121 to 124.

BMW Group

Notes to the Group Financial Statements

Notes to the Income Statement

Sales of products and related goods 38,042 37,138

Income from lease instalments 3,322 2,623

Sale of products previously leased to customers 2,759 2,473

Interest income on loan financing 1,632 1,429

Other income 901 672

Revenues 46,656 44,335