BMW 2005 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2005 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205

|

|

10

dance with IAS 38, so that total additions in 2005

amounted to euro 3,993 million, equivalent to a de-

crease of 8.1% compared to the previous year.

The increase in capitalised development costs

resulted from the higher volume of series develop-

ment projects carried out during the year under

report. The proportion of development costs recog-

nised as assets in 2005 was 44.8% (2004: 39.8%).

Including capitalised development costs, the

capital expenditure ratio in 2005 (i.e. the ratio of

capital expenditure to group revenues) was 8.6%

(2004: 9.8%).

The main emphasis of capital expenditure in

2005 was, once again, the continued expansion of

the BMW Group’s worldwide production network

and of the sales network. As well as further con-

struction work at the BMW Leipzig plant, extensive

measures were taken, and up-front expenditure in-

curred, to expand capacities for new models going

into production at existing plants.

In its financial statements for 2005, the BMW Group has brought the computation of cash flow for external reporting purposes into line with standards normally applied on the

financial markets. In future, the BMW Group will disclose both the figure for the cash flow as defined here and operating cash flow; the latter corresponds to the cash flow from

industrial operations reported in the cash flow statement. The figures for simplified cash flow computation as disclosed previously and of operating cash flow are shown in the

ten-year comparison summary on pages 136 and 137. An exact definition of the two cash flow terms is also given in the glossary on page 140.

Group Management Report 8

A Review of the Financial Year 8

The General Economic Environment 11

Review of operations 15

BMW Stock in 2005 38

Financial Analysis 41

--Internal Management System 41

--Earnings performance 42

--Financial position 45

--Net assets position 46

--Subsequent events report 49

--Value added statement 49

--Key performance figures 51

--Comments on BMW AG 52

Risk Management 56

Outlook 60

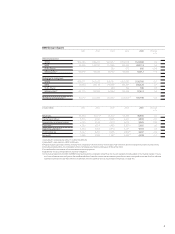

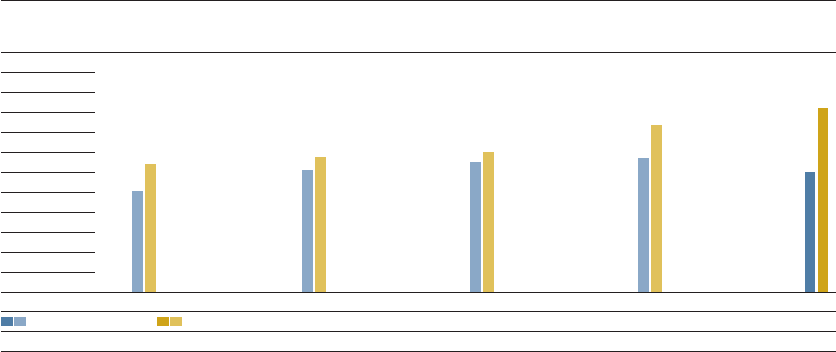

BMW Group capital expenditure and cash flow

in euro million

6,500

6,000

5,500

5,000

4,500

4,000

3,500

3,000

2,500

2,000

1,500

05

Capital expenditure

01

3,993

5,602

3,516

4,202

02

4,042

4,374

03

4,245

4,490

4,347

Cash flow

*adjusted for new accounting treatment of pension obligations

04

5,187*