BMW 2005 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2005 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.25

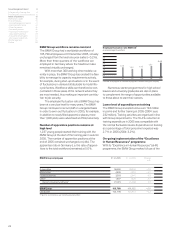

Insurance business grows continuously

As an accompaniment to credit financing and leas-

ing contracts, the Financial Services segment also

operates as an agent for motor vehicle, residual lia-

bility and other vehicle related insurance policies.

This service is now offered in 29 markets via co-

operation arrangements entered into with local in-

surance companies. In 2005, the segment pursued

a strategy of expanding insurance business with

customers in new international markets, whilst also

expanding the range of products on offer in existing

markets. These measures contributed to a very

positive development in the area of car insurance

business, reflected in the 36.1% increase in the

number of new contracts signed and in the 12.5%

increase in the number of contracts in place at the

year-end. At the end of 2005, the segment had a

worldwide portfolio of 431,964 insurance contracts.

Deposit business continues to grow

Deposit business in Germany and in the USA also

developed positively over the course of 2005. The

value of deposits at 31 December 2005 amounted

to euro 6,392 million and was thus 25.3% higher

than one year earlier. The total number of customer

accounts worldwide rose during the year by 39.2%

to 521,175. The objective of encouraging deposit

customers to move into more diversified forms of

investment is successfully being realised with the

help of the tried and tested product combination

“Save& Invest” and, in Germany since October

2005, with the “Save& Plan” savings model which

enables wealth to be accumulated over time.

Fund business continues to make good progress

and to generate high net cash inflows, particularly

as a result of expanding the number of investment

funds on offer. The net cash inflow in 2005 amounted

to euro 115.2 million (+173.0%). By the year-end,

the number of custodial deposit accounts had in-

creased by 37.5% to 27,216.

The BMW Card was introduced in New Zealand

in 2005, thus increasing the number of markets on

which it is available to nine. In addition, the MINI Card

was launched in Germany and Japan in 2005. At the

end of the year under report, the Financial Services

segment was handling 291,674 credit card accounts,

12.4% more than at the end of the previous year.

Risk situation remains evenly balanced

Credit risk for credit and lease financing activities

was further reduced in 2005. Compared to the pre-

vious year, the bad debts ratio fell by 4 basis points

to 0.37%. The main contributing factor was the

on-going development and implementation of risk

management tools. The interest rate risk is managed

using a risk-return approach. Diversified value-at-

risk, as measured by the Financial Services segment

to quantify the interest rate risk*, decreased during

the year from euro 55.4 million to euro 44.2 million.

Softlab strengthens market position

During the past year, the softlab Group continued

to pursue its strategy of expanding activities whilst

focusing on Germany, Austria and Switzerland. It ac-

quired entory AG in July 2005 to add to the acquisi-

tion of axentiv AG in 2004. As a result of its acquisi-

tion of Anite GmbH in April 2005, Softlab Austria

doubled in size. The Softlab Group specialises,

amongst other areas, in customer relationship man-

agement, supply chain management, business in-

telligence, enterprise application integration and

IT services. The Softlab Group will continue in 2006

to take measures to extend its position as a leading

European IT consultant with particular expertise in

the banking, insurance, telecommunication and in-

dustrial sectors. As part of this strategy, it aims to

record significantly higher revenues with non BMW

Group entities.

*based on a 99 % confidence level and a holding period of 10 days