BMW 2005 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2005 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.58

is measured each quarter by comparing forecasted

market values and contractual values according

to model and market.

Provisions and write-downs on leased-out cars

are recognised in the balance sheet to cover all

identified risks. This risk is also reduced by meas-

ures such as active life cycle management and

management of used car markets at an interna-

tional level, both of which have a stabilising effect

on the residual values of BMW Group vehicles.

– Operating risks relating to the provision of finan-

cial services are managed by the BMW Group by

means of a process which records and measures

risks and incorporates specific measures to avoid

risk. In this way, the BMW Group minimises the

risk of losses which could arise as a result of in-

appropriate or failed internal procedures and sys-

tems, human error or external factors.

– The BMW Group mitigates liquidity and interest

rate change risks by matching maturities and

employing derivative financial instruments. Credit

line facilities with various banks ensure liquidity

at all times. As part of a value-based interest rate

management system, interest rate risks are meas-

ured and limited using a value-at-risk approach.

In addition, sensitivity analyses are prepared regu-

larly to measure the potential impact of interest

rate changes on earnings.

– In order to avoid currency risks, financing and

lease business is refinanced as a general rule in

the currency of the relevant market.

A major part of financing and lease business with-

in the Financial Services segment is refinanced

on the capital markets. As a result of its good credit

standing, reflected in the long-standing first-class

short-term ratings issued by Moody’s (P-1) and

Standard& Poor’s (A-1), the BMW Group is able

to obtain competitive conditions. In September

2005, Standard& Poor’s and Moody’s issued

long-term ratings for the BMW Group.Due to its

strong financial and business profile, the BMW

Group has one of the best ratings in the automo-

bile

sector. Moody’s published an A1 rating and

Standard& Poor’s an A+ rating, both with stable

outlook.

– Various methods and systems such as rating and

scoring are in place to manage credit risk, partly in

the light of Basle-II requirements. Depending on

the credit volume applied for and the credit risk

rating of the party involved, financing applications

for international dealers and fleet customers are

presented to the local, regional or corporate credit

committees for approval. A two-step credit appli-

cation process helps to reduce the risk of default

affecting the Group’s worldwide financial services

operations. In another measure to reduce risk,

the BMW Group is continuously making efforts to

standardise credit-decision processes and the

quality of those processes on a worldwide basis,

and to ensure that uniform rating systems are in

place.

For retail customer financing purposes, the BMW

Group uses validated scorecards to reach credit

decisions more quickly and to monitor risk.

Criteria such as arrears and bad debt ratios are

analysed monthly and used to actively manage

the credit portfolio and improve portfolio quality.

Legal risks

– The BMW Group is not involved in any court or

arbitration proceedings which could have a sig-

nificant impact on the economic position of the

Group.

– Like all enterprises, the BMW Group is exposed

to the risk of warranty claims. Adequate provi-

sions have been recognised in the balance sheet

to cover such claims. Part of the risk, especially

where the American market is concerned, has

been insured externally up to economically accept-

able

levels. The high quality of BMW Group prod-

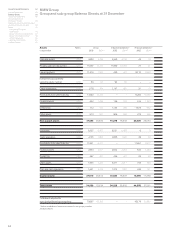

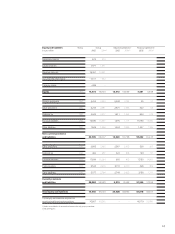

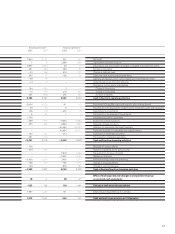

Group Management Report 8

A Review of the Financial Year 8

The General Economic Environment 11

Review of operations 15

BMW Stock in 2005 38

Financial Analysis 41

--Internal Management System 41

--Earnings performance 42

--Financial position 45

--Net assets position 46

--Subsequent events report 49

--Value added statement 49

--Key performance figures 51

--Comments on BMW AG 52

Risk Management 56

Outlook 60