BMW 2005 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2005 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205

|

|

86

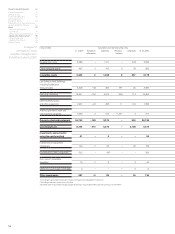

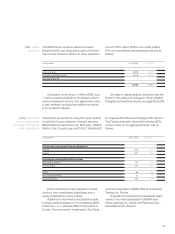

Kingdom of euro1.5 billion (31.12. 2004: euro 1.5 bil-

lion)

were written down in full since these losses can

only be offset against capital gains, and not against

operating profits. At 31 December 2005, a valuation

allowance of euro 188 million (31.12. 2004: euro

146 million) is recognised on deferred tax assets

re-

lating to tax losses available for carryforward amount-

ing

to euro 2.1 billion (31.12. 2004: euro 2.5 billion),

which for the most part can be carried forward with-

A valuation allowance is recognised on de-

ferred tax assets when recoverability is uncertain. In

determining the level of the valuation allowance, all

positive and negative factors concerning the likely

existence of sufficient taxable profit in the future are

taken into account. These estimates can change

depending on the actual course of events. Deferred

tax assets of euro 453 million (31.12.2004: euro

439 million) relating to capital losses in the United

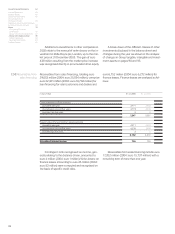

An analysis of deferred taxes tax assets and liabilities by position at 31 December is shown below:

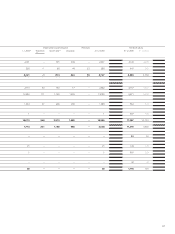

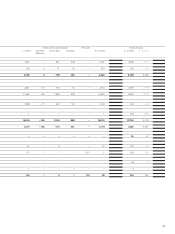

in euro million Deferred tax assets Deferred tax liabilities

2005 2004*2005 2004*

Intangible assets 1 61,594 1,322

Property, plant and equipment 127 401 474 534

Leased products 780 830 3,255 2,695

Investments 16 7––

Current assets 807 569 3,810 4,002

Tax loss carryforwards 947 1,147 ––

Provisions 1,639 1,247 98 191

Liabilities 3,386 3,088 789 584

Consolidations 1,489 1,361 281 209

9,192 8,656 10,301 9,537

Valuation allowance – 641 – 881 ––

Netting – 7,779 – 7,260 – 7,779 – 7,260

772 515 2,522 2,277

*adjusted in accordance with Note [8] (b)

Group Financial Statements 62

Income Statements 63

Balance Sheets 64

Cash Flow Statements 66

Group Statement of

Changes in Equity 68

Statement of Income and Expenses

recognised directly in Equity 69

Notes 70

--Accounting Principles

and Policies 70

--Notes to the Income Statement 81

--Notes to the balance sheet 90

--Other Disclosures 114

--Segment Information 121

Auditors’ Report 125