BMW 2005 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2005 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205

|

|

87

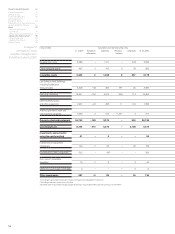

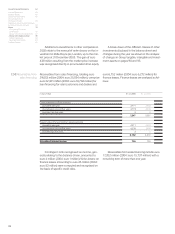

The decrease in tax expense in 2005 is attribut-

able to tax reimbursements for prior years and the

reversal of valuation allowances on deferred tax as-

sets relating to capital allowances in the United

Kingdom as a result of a renewed assessment of

recoverability.

out restriction. No valuation allowance is recognised

on deferred tax assets at 31 December 2005 for

capital allowances on property, plant and equipment

in the United Kingdom (31.12. 2004:euro 296 million).

In total, euro 240 million of the valuation allowance

on deferred tax assets was reversed in the financial

year 2005 (2004: euro 220 million). As a result of

newly gained information, deferred tax assets of

euro 202 million on capital allowances, which had

been fully written down in the past, were written off

without further profit or loss effect.The use of capital

allowances in the United Kingdom gave rise to a

deferred tax expense of euro 66 million (2004: euro

127 million); on the other hand, the valuation allow-

ance increased by euro 36 million (without profit or

loss effect) as a result of translation differences.

Interest and currency derivatives recognised di-

rectly in equity were euro 1,670 million (gross) lower

at the end of 2005 than one year earlier as a result

of reduced volumes and lower fair values. Deferred

tax liabilities recognised directly in equity fell corre-

spondingly by euro 627 million.

The actual tax expense for the financial year

2005 of euro1,048 million (2004: euro 1,341 million

*

)

is euro 231 million (2004: euro 53 million*) lower

than the expected tax expense of euro 1,279 million

(2004: euro1,394 million*) which would theoretically

arise if the tax rate of 38.9% (unchanged from the

previous year), applicable for German companies, was

applied across the Group. The difference between

the expected and actual tax expense is attributable

to the following:

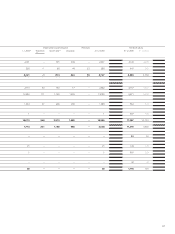

in euro million 2005 2004*

Expected tax expense 1,279 1,394

Variances due to different tax rates –123 – 117

Tax reductions (–)/tax increases (+) as a result of non-taxable income and

non-deductible expenses 158 –77

Tax expense (+)/benefits (–) for prior periods – 232 198

Other variances –34 –57

Actual tax expense 1,048 1,341

*adjusted in accordance with Note [8] (b)