BMW 2005 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2005 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.100

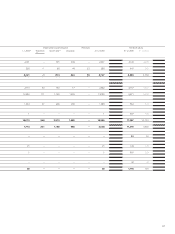

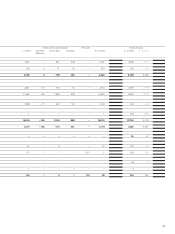

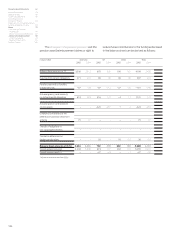

The Group Statement of Changes in Equity is shown

on page 68.

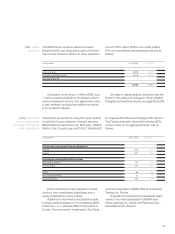

Number of shares issued

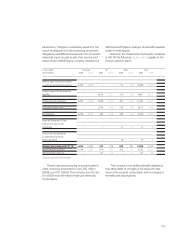

At 31 December 2005, common stock issued by

BMW AG is divided, as at the end of the previous

year, into 622,227,918 shares with a par-value of one

euro. Preferred stock issued by BMW AG is divided

into 52,196,162 shares with a par-value of one euro,

also unchanged from the previous year. Unlike the

common stock, no voting rights are attached to the

preferred stock. All of the company’s stock is issued

in the form of bearer shares. Preferred stock bears

an advance profit (additional dividend) of euro 0.02

per share. 708,025 of the shares of preferred stock

are only entitled to receive dividends with effect from

the beginning of the financial year 2006.

During the financial year 2005, BMW Group ac-

quired 708,025 of its own (treasury) shares of pre-

ferred stock at an average price of euro 28.68 per

share; these shares were issued to employees at a

reduced price of euro 18.99 per share in conjunction

with an employee share scheme. As a result of

the repurchase of shares of preferred stock and their

subsequent issue, the preferred stock portion of

share capital remained unchanged at euro 52 million.

At the Annual General Meeting of BMW AG on

12 May 2005, the shareholders authorised the

Board of Management to acquire treasury shares

via the stock exchange, up to a maximum of 10% of

the share capital in place at the date of the resolu-

tion and to withdraw those shares for circulation

without any further resolution by the Annual General

Meeting.The authorisation for the buy-back remains

valid until 11 November 2006.

In conjunction with this authorisation, the Board

of Management of BMW AG resolved on 20 Septem-

ber 2005 to put a programme in place to buy-back

shares via the stock exchange. Under this programme,

up to 3% of common stock will be acquired.The

extent to which BMW AG will acquire more than this

level as part of the currently valid authorisation, has

not yet been decided.

The shares will be acquired with the purpose of

withdrawing them from circulation and reducing

share capital.

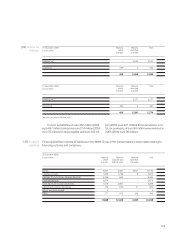

Up to 31December 2005, a total of 13,488,480

treasury shares of common stock had been bought

back via the stock exchange at an average price

per share of euro 37.49 and a total acquisition cost

of euro 506 million. The number of shares so pur-

chased corresponds to 2% of the share capital.The

shares are held by BMW AG at the balance sheet

date. Equity has been reduced by the buy-back

amount.

Transaction costs amounted to approximately

euro 560 thousand (net of deferred taxes) and have

been recognised directly in equity.

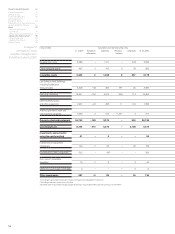

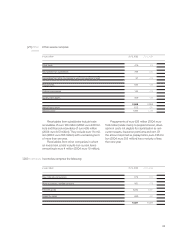

[31]Equity

[30]Cash and cash

equivalents

[29]Trade receivables

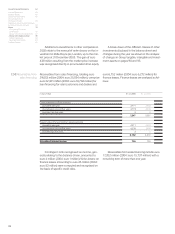

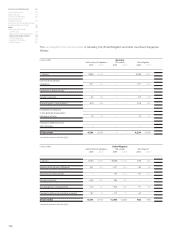

At 31 December 2005, inventories measured at

their net realisable value amounted to euro 268 mil-

lion (2004: euro 437 million) and are included in

total inventories of euro 6,527 million (2004: euro

6,467 million). Write-downs to net realisable value

amounting to euro 10 million (2004: euro 49 million)

were recognised in 2005. Amounts recognised as

income from the reversal of write-downs were not

significant.

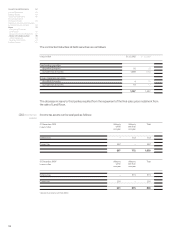

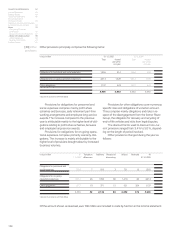

Cash and cash equivalents of euro 1,621million

(2004: euro 2,128 million), comprising cash on

hand and at bank, have a maturity of under three

months.

Cash and cash equivalents include euro 43 mil-

lion assigned as collateral to Deutsche Treuinvest

Stiftung, Frankfurt am Main, to secure obligations re-

lating to pre-retirement part-time work arrangements.

Trade receivables amounting to euro 2,135 million

(2004: euro1,868 million) are all due within one year

(2004: euro1 million with a maturity of more than one

year).

Group Financial Statements 62

Income Statements 63

Balance Sheets 64

Cash Flow Statements 66

Group Statement of

Changes in Equity 68

Statement of Income and Expenses

recognised directly in Equity 69

Notes 70

--Accounting Principles

and Policies 70

--Notes to the Income Statement 81

--Notes to the balance sheet 90

--Other Disclosures 114

--Segment Information 121

Auditors’ Report 125