Avon 2014 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2014 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

During the fourth quarter of 2014, the Company’s expected net foreign source income was reduced significantly, primarily due to the

strengthening of the U.S. dollar against currencies for some of our key markets and, to a lesser extent, the finalization of the Foreign

Corrupt Practices Act (“FCPA”) settlements. This strengthening of the U.S. dollar reduced the expected dividends and royalties that could be

remitted to the U.S. by our foreign subsidiaries, particularly Russia, Brazil, Mexico and Colombia. The effectiveness of our tax planning

strategies, including the repatriation of foreign earnings and the acceleration of royalties from our foreign subsidiaries, was also negatively

impacted by the strengthening of the U.S. dollar. In addition, the finalization of the FCPA settlements, which included a $68 fine related to

Avon China in connection with the U.S. Department of Justice (“DOJ”) settlement and $67 in disgorgement and prejudgment interest

related to Avon Products, Inc. in connection with the U.S. Securities and Exchange Commission (“SEC”) settlement, negatively impacted

expected future repatriation of foreign earnings and reduced current U.S. taxable income, respectively. As a result of these developments,

we may not generate sufficient taxable income to realize all of our U.S. deferred tax assets. As such, we recorded a valuation allowance of

$441 to reduce our U.S. deferred tax assets to an amount that is “more likely than not” to be realized, of which $367 was recorded to

income taxes in the Consolidated Statements of Income and the remainder was recorded to various components of other comprehensive

(loss) income.

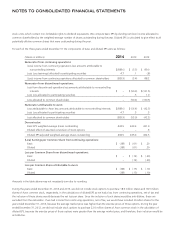

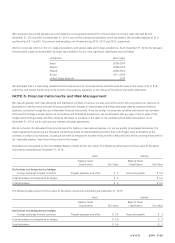

(Loss) income from continuing operations, before taxes for the years ended December 31 was as follows:

2014 2013 2012

United States $(214.7) $(500.8) $(227.7)

Foreign 378.9 663.4 656.4

Total $ 164.2 $ 162.6 $ 428.7

The U.S. loss from continuing operations, before taxes, for the years ended December 31, 2014, 2013 and 2012, does not include dividend

income from foreign subsidiaries.

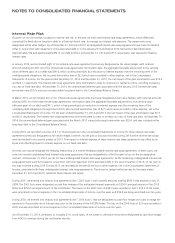

The provision for income taxes for the years ended December 31 was as follows:

2014 2013 2012

Federal:

Current $ 58.0 $ 76.6 $ 38.8

Deferred 208.0 (212.5) (111.5)

266.0 (135.9) (72.7)

Foreign:

Current 246.7 216.3 267.5

Deferred (3.3) 90.5 143.6

243.4 306.8 411.1

State and other:

Current (.1) (.7) 1.2

Deferred 39.8 (6.6) (4.2)

39.7 (7.3) (3.0)

Total $549.1 $ 163.6 $ 335.4

The foreign provision for income taxes includes the U.S. tax benefit on foreign earnings of $3.5, and the U.S. tax cost on foreign earnings of

$9.9 and $156.8 for the years ended December 31, 2014, 2013 and 2012, respectively.

A V O N 2014 F-23