Avon 2014 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2014 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

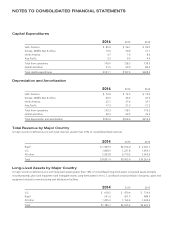

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

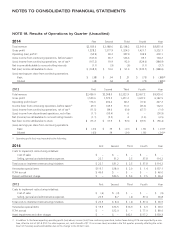

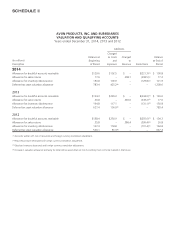

NOTE 18. Results of Operations by Quarter (Unaudited)

2014 First Second Third Fourth Year

Total revenue $2,183.6 $2,188.6 $2,138.2 $2,341.0 $8,851.4

Gross profit 1,228.2 1,377.9 1,324.3 1,421.7 5,352.1

Operating (loss) profit(1) (50.9) 93.2 187.9 169.9 400.1

(Loss) income from continuing operations, before taxes(2) (141.0) 65.7 144.4 95.1 164.2

(Loss) income from continuing operations, net of tax(3) (167.2) 19.9 92.0 (329.6) (384.9)

Net income attributable to noncontrolling interests (1.1) (.9) (.6) (1.1) (3.7)

Net (loss) income attributable to Avon $ (168.3) $ 19.0 $ 91.4 $ (330.7) $ (388.6)

(Loss) earnings per share from continuing operations

Basic $ (.38) $ .04 $ .21 $ (.75) $ (.88)(4)

Diluted (.38) .04 .21 (.75) (.88)(4)

2013 First Second Third Fourth Year

Total revenue $2,456.0 $2,508.9 $2,322.9 $2,667.2 $9,955.0

Gross profit 1,530.6 1,573.5 1,451.2 1,627.2 6,182.5

Operating profit (loss)(1) 174.0 202.2 68.2 (17.2) 427.2

Income (loss) from continuing operations, before taxes(2) 29.3 145.3 31.6 (43.6) 162.6

(Loss) income from continuing operations, net of tax(3) (11.5) 84.6 (6.4) (67.7) (1.0)

(Loss) income from discontinued operations, net of tax (1.1) (50.4) .6 – (50.9)

Net (income) loss attributable to noncontrolling interests (1.1) (2.3) .3 (1.4) (4.5)

Net (loss) income attributable to Avon $ (13.7) $ 31.9 $ (5.5) $ (69.1) $ (56.4)

(Loss) earnings per share from continuing operations

Basic $ (.03) $ .19 $ (.01) $ (.16) $ (.01)(4)

Diluted (.03) .19 (.01) (.16) (.01)(4)

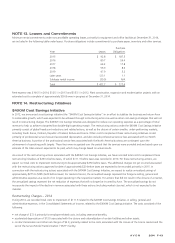

(1) Operating profit (loss) was impacted by the following:

2014 First Second Third Fourth Year

Costs to implement restructuring initiatives:

Cost of sales $ – $ – $ – $ – $ –

Selling, general and administrative expenses 22.7 51.2 2.5 37.8 114.2

Total costs to implement restructuring initiatives $ 22.7 $51.2 $ 2.5 $ 37.8 $114.2

Venezuelan special items $115.7 $18.0 $ 2.0 $ 1.4 $137.1

FCPA accrual $ 46.0 $ – $ – $ – $ 46.0

Pension settlement charge $ – $23.5 $ 5.4 $ 7.5 $ 36.4

2013 First Second Third Fourth Year

Costs to implement restructuring initiatives:

Cost of sales $ (.6) $ (.3) $ – $ – $ (.9)

Selling, general and administrative expenses 20.9 8.7 (.2) 37.4 66.8

Total costs to implement restructuring initiatives $ 20.3 $ 8.4 $ (.2) $ 37.4 $ 65.9

Venezuelan special items $ 13.3 $16.5 $14.9 $ 4.9 $ 49.6

FCPA accrual $ – $12.0 $ – $ 77.0 $ 89.0

Asset impairment and other charges $ – $ – $42.1 $117.2 $159.3

(2) In addition to the items impacting operating profit (loss) above, income (loss) from continuing operations, before taxes during 2014 was impacted by a one-

time, after-tax loss of $41.8 ($53.7 in other expense, net, and a benefit of $11.9 in income taxes) recorded in the first quarter, primarily reflecting the write-

down of monetary assets and liabilities due to the change to the SICAD II rate.