Avon 2014 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2014 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

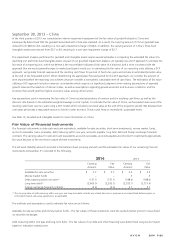

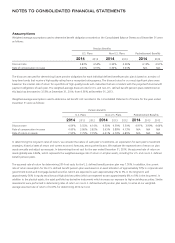

Assets and Liabilities Recorded at Fair Value on a Recurring Basis

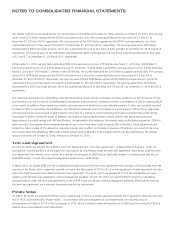

The following table presents the fair value hierarchy for those assets and liabilities measured at fair value on a recurring basis as of

December 31, 2014:

Level 1 Level 2 Total

Assets:

Available-for-sale securities $ 2.7 $ – $ 2.7

Foreign exchange forward contracts – .6 .6

Total $ 2.7 .6 3.3

Liabilities:

Foreign exchange forward contracts $ – $ 5.0 $ 5.0

Total $ – $ 5.0 $ 5.0

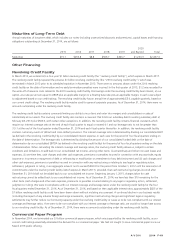

The following table presents the fair value hierarchy for those assets and liabilities measured at fair value on a recurring basis as of

December 31, 2013:

Level 1 Level 2 Total

Assets:

Money market funds $ .5 $ – $ .5

Available-for-sale securities 2.5 – 2.5

Foreign exchange forward contracts – 3.4 3.4

Total $ 3.0 $ 3.4 $ 6.4

Liabilities:

Foreign exchange forward contracts $ – $ .3 $ .3

Total $ – $ .3 $ .3

The tables above exclude our defined benefit pension and postretirement plan assets. See Note 11, Employee Benefit Plans, for the fair value

hierarchy for our plan assets. The money market funds were held in a Healthcare trust in order to fund future benefit payments for both

active and retiree benefit plans (see Note 11, Employee Benefit Plans). The available-for-sale securities include securities held in a trust in

order to fund future benefit payments for non-qualified retirement plans (see Note 11, Employee Benefit Plans). The foreign exchange

forward contracts are hedges of either recorded assets or liabilities or anticipated transactions. The underlying hedged assets and liabilities or

anticipated transactions are not reflected in the table above (see Note 8, Financial Instruments and Risk Management).

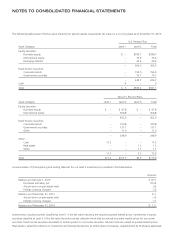

Assets and Liabilities Recorded at Fair Value on a Non-recurring Basis

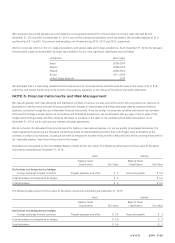

December 31, 2013 – SMT

In December 2013, we decided to halt further roll-out of our SMT project beyond the pilot program in Canada, in light of the potential risk

of further business disruption. As a result, in the fourth quarter of 2013, we completed an impairment assessment of the SMT asset and

subsequently determined that the SMT asset was impaired. As a result of the non-cash impairment charge of $117.2 before tax ($74.1 after

tax), the remaining carrying amount of the SMT asset is not material.

The fair value of the SMT asset was determined using a risk-adjusted DCF model under the relief-from-royalty method. The impairment

analysis performed for the asset group, which includes the SMT asset, required several estimates, including revenue and cash flow

projections, and royalty and discount rates.

See Note 1, Description of the Business and Summary of Significant Accounting Policies for more information on SMT.