Avon 2014 Annual Report Download - page 85

Download and view the complete annual report

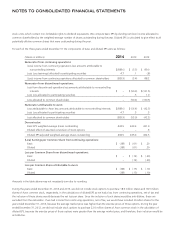

Please find page 85 of the 2014 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.testing goodwill for impairment, we perform either a qualitative or quantitative assessment for each of our reporting units. Factors

considered in the qualitative analysis include macroeconomic conditions, industry and market considerations, cost factors and overall

financial performance specific to the reporting unit. If the qualitative analysis results in a more likely than not probability of impairment, the

first quantitative step, as described below, is required.

The quantitative test to evaluate goodwill for impairment is a two-step process. In the first step, we compare the fair value of a reporting

unit to its carrying value. If the fair value of a reporting unit is less than its carrying value, we perform a second step to determine the implied

fair value of the reporting unit’s goodwill. The second step of the impairment analysis requires a valuation of a reporting unit’s tangible and

intangible assets and liabilities in a manner similar to the allocation of the purchase price in a business combination. If the resulting implied

fair value of the reporting unit’s goodwill is less than its carrying value, that difference represents an impairment.

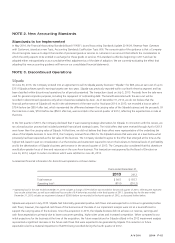

The impairment analysis performed for goodwill requires several estimates in computing the estimated fair value of a reporting unit. We

typically use a DCF approach to estimate the fair value of a reporting unit, which we believe is the most reliable indicator of fair value of this

business, and is most consistent with the approach that we would generally expect a marketplace participant would use. In estimating the

fair value of our reporting units utilizing a DCF approach, we typically forecast revenue and the resulting cash flows for periods of five to ten

years and include an estimated terminal value at the end of the forecasted period. When determining the appropriate forecast period for the

DCF approach, we consider the amount of time required before the reporting unit achieves what we consider a normalized, sustainable level

of cash flows. The estimation of fair value utilizing a DCF approach includes numerous uncertainties which require significant judgment

when making assumptions of expected growth rates and the selection of discount rates, as well as assumptions regarding general economic

and business conditions, and the structure that would yield the highest economic value, among other factors.

Indefinite-lived intangible assets are not amortized, but rather are assessed for impairment annually during the fourth quarter or on the

occurrence of an event that indicates impairment may have occurred. When testing indefinite-lived intangible assets for impairment, we

perform either a qualitative or quantitative assessment. If the qualitative analysis results in a more likely than not probability of impairment, a

quantitative assessment is required. The quantitative test to evaluate indefinite-lived intangible assets for impairment compares the fair value

of the intangible asset to its carrying value. If the fair value of the asset is less than its carrying value, that difference represents an

impairment. The impairment analysis performed for indefinite-lived intangible asset requires several estimates in computing the estimated

fair value of the asset. We use a risk-adjusted DCF model under the relief-from-royalty method.

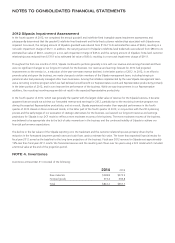

Finite-lived intangible assets are amortized using a straight-line method over their estimated useful lives. Intangible assets are reviewed for

impairment whenever events or changes in circumstances indicate that the carrying amount may not be fully recoverable. If such a change in

circumstances occurs, the related estimated future pre-tax undiscounted cash flows expected to result from the use of the asset and its

eventual disposition are compared to the carrying amount. If the sum of the expected cash flows is less than the carrying amount, an

impairment charge is recorded. The impairment charge is measured as the amount by which the carrying amount exceeds the fair value of

the asset. The fair value of the asset is determined using probability weighted expected cash flow estimates, quoted market prices when

available and appraisals, as appropriate.

If applicable, the impairment testing should be performed in the following order: indefinite-lived intangible assets, finite-lived intangible

assets, and then goodwill.

See Note 16, Goodwill and Intangible Assets for more information on China, and Note 3, Discontinued Operations for more information on

Silpada.

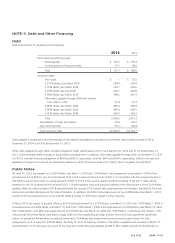

Financial Instruments

We use derivative financial instruments, including forward foreign currency contracts, to manage foreign currency exposures.

If applicable, derivatives are recognized on the Consolidated Balance Sheets at their fair values. When we become a party to a derivative

instrument and intend to apply hedge accounting, we designate the instrument, for financial reporting purposes, as a fair value hedge, a

cash flow hedge, or a net investment hedge. The accounting for changes in fair value (gains or losses) of a derivative instrument depends on

whether we had designated it and it qualified as part of a hedging relationship and further, on the type of hedging relationship. We apply

the following:

• Changes in the fair value of a derivative that is designated as a fair value hedge, along with the loss or gain on the hedged asset or liability

that is attributable to the hedged risk are recorded in earnings.

A V O N 2014 F-11