Avon 2014 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2014 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

Notes (as defined below), the repayment of $498 of the outstanding principal amount of the term loan agreement (as defined below), the

scheduled repayment of $250 principal amount of the 4.80% Notes, due March 1, 2013, and the scheduled repayment of $125 principal

amount of the 4.625% Notes, due May 15, 2013, which were partially offset by the proceeds of $1.5 billion related to issuance of the Notes

(as defined below) and proceeds of $88 related to the termination of interest-rate swap agreements designated as fair value hedges. See

Note 5, Debt and Other Financing on pages F-17 through F-20 of our 2014 Annual Report, and Note 8, Financial Instruments and Risk

Management on pages F-25 through F-27 of our 2014 Annual Report for more information.

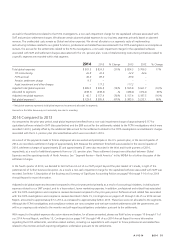

Net cash used by continuing financing activities was approximately $468 during 2013 compared to approximately $401 during 2012

primarily due to the significant repayments and prepayments in 2013 (as discussed above) and lower debt issuances in various markets. This

was partially offset by proceeds of $1.5 billion related to issuance of the Notes (as defined below) in the first quarter of 2013 as compared to

proceeds of $550 related to borrowings under our term loan agreement (as defined below) in 2012, as well as lower repayments of

commercial paper and lower dividend payments in 2013. See Note 5, Debt and Other Financing on pages F-17 through F-20 of our 2014

Annual Report for more information. In addition, during 2013 we had proceeds of approximately $88 related to the termination of interest-

rate swap agreements designated as fair value hedges, compared to proceeds of approximately $44 during 2012. See Note 8, Financial

Instruments and Risk Management on pages F-25 through F-27 of our 2014 Annual Report for more information.

We purchased approximately .7 million shares of our common stock for $9.8 during 2014, as compared to .5 million shares of our common

stock for $9.4 during 2013 and .5 million shares for $8.8 during 2012, through repurchases by the Company in connection with employee

elections to use shares to pay withholding taxes upon the vesting of their restricted stock units and private transactions with a broker in

connection with stock based obligations under our Deferred Compensation Plan.

We have maintained a quarterly dividend of $.06 per share for 2014, which was equivalent to our quarterly dividends in 2013. During the

first nine months of 2012 our quarterly dividend payments were $.23 per share, whereas in the fourth quarter of 2012 our quarterly

dividend payment was $.06 per share. We have maintained the dividend of $.06 per share for the first quarter of 2015.

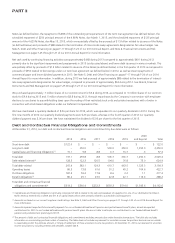

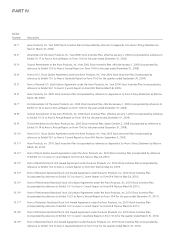

Debt and Contractual Financial Obligations and Commitments

At December 31, 2014, our debt and contractual financial obligations and commitments by due dates were as follows:

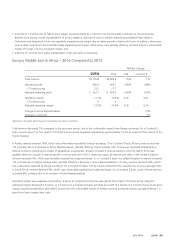

2015 2016 2017 2018 2019

2020

and Beyond Total

Short-term debt $122.0 $ – $ – $ – $ – $ – $ 122.0

Long-term debt – 250.0 – 500.0 350.0 1,250.0 2,350.0

Capital lease and financing obligations(1) 15.1 9.8 8.8 6.7 16.7 .3 57.4

Total debt 137.1 259.8 8.8 506.7 366.7 1,250.3 2,529.4

Debt-related interest(2) 128.3 122.3 120.5 104.0 76.8 73.0 624.9

Total debt-related 265.4 382.1 129.3 610.7 443.5 1,323.3 3,154.3

Operating leases 86.3 73.8 61.6 51.2 45.2 104.6 422.7

Purchase obligations 187.3 59.4 17.8 8.6 3.2 1.1 277.4

Benefit obligations(3) 80.2 25.1 23.6 22.8 22.1 114.4 288.2

Total debt and contractual financial

obligations and commitments(4) $619.2 $540.4 $232.3 $693.3 $514.0 $1,543.4 $4,142.6

(1) Capital lease and financing obligations is primarily comprised of $40.4 related to the sale and leaseback of equipment in one of our distribution facilities in

North America entered into in 2009 and $11.6 of capital leases which were primarily related to automobiles and equipment.

(2) Amounts are based on our current long-term credit ratings. See Note 5, Debt and Other Financing on pages F-17 through F-20 of our 2014 Annual Report for

more information.

(3) Amounts represent expected future benefit payments for our unfunded defined benefit pension and postretirement benefit plans, as well as expected

contributions for 2015 to our funded defined benefit pension benefit plans. We are not able to estimate our contributions to our funded defined benefit

pension and postretirement plans beyond 2015.

(4) The amount of debt and contractual financial obligations and commitments excludes amounts due under derivative transactions. The table also excludes

information on non-binding purchase orders of inventory. The table does not include any reserves for uncertain income tax positions because we are unable

to reasonably predict the ultimate amount or timing of settlement of these uncertain income tax positions. At December 31, 2014, our reserves for uncertain

income tax positions, including interest and penalties, totaled $44.6.