Avon 2014 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2014 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

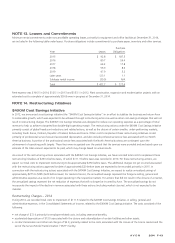

Under the DPA, the Company also represented that it has implemented and agreed that it will continue to implement a compliance and

ethics program designed to prevent and detect violations of the FCPA and other applicable anti-corruption laws throughout its operations.

The monitor will assess and monitor the Company’s compliance with the terms of the DPA and Consent by evaluating, among other things,

the Company’s internal accounting controls, recordkeeping and financial reporting policies and procedures. The monitor may recommend

changes to our policies and procedures that we must adopt unless they are unduly burdensome or otherwise inadvisable, in which case we

may propose alternatives, which the DOJ and the SEC may or may not accept. In addition, operating under the oversight of the monitor may

result in burdens on members of our management and divert their time from the operation of our business. Assuming the monitorship is

replaced by a self-reporting period, the Company’s self-reporting obligations may continue to be costly or burdensome.

We currently cannot estimate the costs that we are likely to incur in connection with compliance with the DPA and the Consent, including

the retention of the monitor, the costs, if applicable, of self-reporting, and the costs of implementing the changes, if any, to our policies and

procedures required by the monitor. However, the costs and burdens of the monitoring process could be significant.

FCPA-Related Litigation Matters

In July and August 2010, derivative actions were filed in state court against certain present or former officers and/or directors of the

Company (Carol J. Parker, derivatively on behalf of Avon Products, Inc. v. W. Don Cornwell, et al. and Avon Products, Inc. as nominal

defendant (filed in the New York Supreme Court, Nassau County, Index No. 600570/2010); Lynne Schwartz, derivatively on behalf of Avon

Products, Inc. v. Andrea Jung, et al. and Avon Products, Inc. as nominal defendant (filed in the New York Supreme Court, New York County,

Index No. 651304/2010)). On November 22, 2013, a derivative action was filed in federal court against certain present or former officers

and/or directors of the Company (Sylvia Pritika, derivatively on behalf of Avon Products, Inc. v. Ann S. Moore, et al. and Avon Products, Inc.

as nominal defendant (filed in the United States District Court for the Southern District of New York, No. 13-CV-8369)). The claims asserted

in one or more of these actions include alleged breach of fiduciary duty, abuse of control, waste of corporate assets, and unjust enrichment,

relating to the Company’s compliance with the FCPA, including the adequacy of the Company’s internal controls. The relief sought against

the individual defendants in one or more of these derivative actions include certain declaratory and equitable relief, restitution, damages,

exemplary damages and interest. The Company is a nominal defendant, and no relief is sought against the Company itself. In the Parker

case, plaintiff has agreed that defendants’ time to file an answer, motion to dismiss or other response is adjourned until plaintiff files an

amended pleading. In Schwartz, the parties have agreed to a stipulated schedule for further proceedings, which provides, among other

things, for plaintiffs to file a further amended complaint and for defendants to file a motion to dismiss. In Pritika, defendants moved to

dismiss the complaint on March 7, 2014. We are unable to predict the outcome of these matters.

On July 6, 2011, a purported shareholder’s class action complaint (City of Brockton Retirement System v. Avon Products, Inc., et al., No. 11-

CIV-4665) was filed in the United States District Court for the Southern District of New York against the Company and certain present or

former officers and/or directors of the Company. On September 29, 2011, the Court appointed LBBW Asset Management

Investmentgesellschaft mbH and SGSS Deutschland Kapitalanlagegesellschaft mbH as lead plaintiffs and Motley Rice LLC as lead counsel.

Lead plaintiffs filed an amended complaint, and the defendants moved to dismiss the amended complaint on June 14, 2012. On

September 29, 2014, the Court granted the defendants’ motion to dismiss and also granted the plaintiffs leave to amend their complaint.

On October 24, 2014, plaintiffs filed their second amended complaint on behalf of a purported class consisting of all persons or entities who

purchased or otherwise acquired shares of Avon’s common stock from July 31, 2006 through and including October 26, 2011. The second

amended complaint names as defendants the Company and two individuals and asserts violations of Sections 10(b) and 20(a) of the

Exchange Act based on allegedly false or misleading statements and omissions with respect to, among other things, the Company’s

compliance with the FCPA, including the adequacy of the Company’s internal controls. Plaintiffs seek compensatory damages and

declaratory, injunctive, and other equitable relief. Defendants moved to dismiss the Second Amended Complaint on November 21, 2014.

We are unable to predict the outcome of this matter. However, it is reasonably possible that we may incur a loss in connection with this

matter. We are unable to reasonably estimate the amount or range of such reasonably possible loss.

On December 23, 2014, a purported class action (Poovathur v. Avon Products, Inc., et al., No. 14-CV-10083) was filed in the United States

District Court for the Southern District of New York against the Company and certain present or former Company employees pursuant to

the Employee Retirement Income Security Act (“ERISA”), 29 U.S.C. § 1132. An amended complaint was filed on January 28, 2015. The

purported class consists of participants in and beneficiaries of the Avon Personal Savings Account Plan (the “Plan”) who invested in and/or

held shares of the Avon Common Stock Fund between July 31, 2006 and January 1, 2015. The claims asserted in this action include, inter

alia, alleged breach of fiduciary duties in connection with the administration and management of the Plan and the appointment, evaluation,