Avon 2014 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2014 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

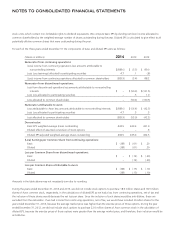

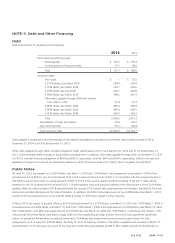

NOTE 5. Debt and Other Financing

Debt

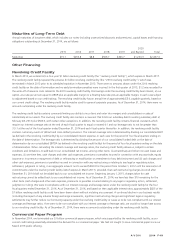

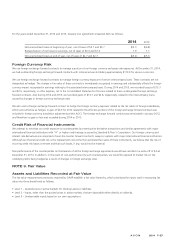

Debt at December 31 consisted of the following:

2014 2013

Debt maturing within one year:

Notes payable $ 122.0 $ 159.4

Current portion of long-term debt 15.1 28.6

Total $ 137.1 $ 188.0

Long-term debt:

Term Loan $ – $ 52.5

2.375% Notes, due March 2016 249.9 249.9

5.75% Notes, due March 2018 249.7 249.6

4.20% Notes, due July 2018 249.7 249.6

6.50% Notes, due March 2019 348.2 347.7

Other debt, payable through 2024 with interest

from .6% to 7.4% 57.4 67.9

4.60% Notes, due March 2020 499.4 499.3

5.00% Notes, due March 2023 496.0 495.5

6.95% Notes, due March 2043 249.3 249.3

Total 2,399.6 2,461.3

Amortization of swap termination 79.4 100.0

Less current portion (15.1) (28.6)

Total long-term debt $2,463.9 $2,532.7

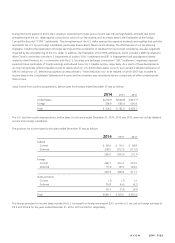

Notes payable included short-term borrowings of international subsidiaries at average annual interest rates of approximately 4.2% at

December 31, 2014 and 6.5% at December 31, 2013.

Other debt, payable through 2024, included obligations under capital leases of $11.6 at December 31, 2014 and $11.6 at December 31,

2013, which primarily relate to leases of automobiles and equipment. In addition, other debt, payable through 2024, at December 31, 2014

and 2013, included financing obligations of $45.8 and $56.3, respectively, of which $40.4 and $44.5, respectively, relates to the sale and

leaseback of equipment in one of our distribution facilities in North America entered into in 2009, which is payable through 2019.

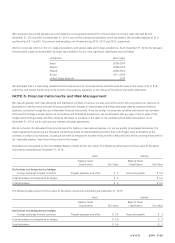

Public Notes

On April 15, 2013, we prepaid our 5.625% Notes, due March 1, 2014 (the “2014 Notes”) at a prepayment price equal to 100% of the

principal amount of $500.0, plus accrued interest of $3.4 and a make-whole premium of $21.7. In connection with the prepayment of our

2014 Notes, we incurred a loss on extinguishment of debt of $13.0 in the second quarter of 2013 consisting of the $21.7 make-whole

premium for the 2014 Notes and the write-off of $1.1 of debt issuance costs and discounts related to the initial issuance of the 2014 Notes,

partially offset by a deferred gain of $9.8 associated with the January 2013 interest-rate swap agreement termination. See Note 8, Financial

Instruments and Risk Management for more information. In addition, the $250.0 principal amount of our 4.80% Notes due March 1, 2013

and the $125.0 principal amount of our 4.625% Notes due May 15, 2013 were repaid in full at maturity.

In March 2013, we issued, in a public offering, $250.0 principal amount of 2.375% Notes, due March 15, 2016 (the “2016 Notes”), $500.0

principal amount of 4.60% Notes, due March 15, 2020 (the “2020 Notes”), $500.0 principal amount of 5.00% Notes, due March 15, 2023

(the “2023 Notes”) and $250.0 principal amount of 6.95% Notes, due March 15, 2043 (the “2043 Notes”) (collectively, the “Notes”). The

net proceeds from these Notes were used to repay $380.0 of the outstanding principal amount of the term loan agreement (as defined

below), to prepay the Private Notes (as defined below) and 2014 Notes (plus make-whole premium and accrued interest for both

prepayments), and to repay the 4.625% Notes, due May 15, 2013 at maturity. Interest on the Notes is payable semi-annually on March 15

and September 15 of each year. As a result of the long-term credit rating downgrades by S&P to BB+ (Stable outlook) and by Moody’s to

A V O N 2014 F-17