Avon 2014 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2014 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

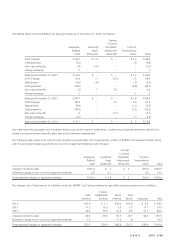

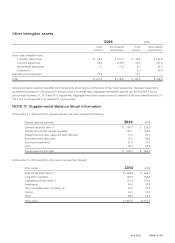

Other intangible assets

2014 2013

Gross

Amount

Accumulated

Amortization

Gross

Amount

Accumulated

Amortization

Finite-Lived Intangible Assets

Customer relationships $ 33.0 $ (31.1) $ 39.9 $ (36.5)

Licensing agreements 43.4 (39.9) 52.3 (47.3)

Noncompete agreements 7.2 (7.2) 8.1 (8.1)

Trademarks – – 6.6 (6.6)

Indefinite-Lived Trademarks 23.6 – 25.1 –

Total $ 107.2 $ (78.2) $ 132.0 $ (98.5)

Actual amortization expense may differ from the amounts above due to, among other things, future acquisitions, disposals, impairments,

accelerated amortization or fluctuations in foreign currency exchange rates. Aggregate amortization expense was $4.4 and $9.5 for the

years ended December 31, 2013 and 2012, respectively. Aggregate amortization expense was not material for the year ended December 31,

2014, and is not expected to be material for future periods.

NOTE 17. Supplemental Balance Sheet Information

At December 31, 2014 and 2013, prepaid expenses and other included the following:

Prepaid expenses and other 2014 2013

Deferred tax assets (Note 7) $ 204.7 $ 233.6

Prepaid taxes and tax refunds receivable 165.7 145.9

Prepaid brochure costs, paper and other literature 77.6 95.7

Receivables other than trade 72.5 86.6

Short-term investments 21.0 31.7

Other 76.8 95.8

Prepaid expenses and other $ 618.3 $ 689.3

At December 31, 2014 and 2013, other assets included the following:

Other assets 2014 2013

Deferred tax assets (Note 7) $ 685.8 $ 944.7

Long-term receivables 149.5 168.0

Capitalized software (Note 1) 101.3 122.9

Investments 36.4 33.8

Other intangible assets, net (Note 16) 29.0 33.5

Tooling 21.7 37.9

Other 28.3 34.5

Other assets $1,052.0 $1,375.3

A V O N 2014 F-51