Avon 2014 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2014 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

accrual for the settlements related to the FCPA investigations, a non-cash impairment charge for the capitalized software associated with

SMT and pension settlement charges. We allocate certain planned global expenses to our business segments primarily based on planned

revenue. The unallocated costs remain as Global and other expenses. We do not allocate to our segments costs of implementing

restructuring initiatives related to our global functions, professional and related fees associated with the FCPA investigations and compliance

reviews, the accrual for the settlements related to the FCPA investigations, a non-cash impairment charge for the capitalized software

associated with SMT and settlement charges associated with the U.S. pension plan. Costs of implementing restructuring initiatives related to

a specific segment are recorded within that segment.

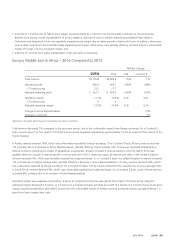

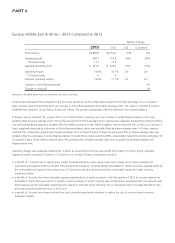

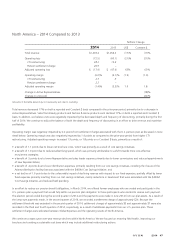

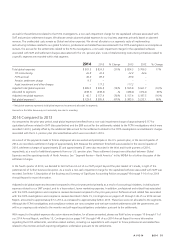

2014 2013 % Change 2013 2012 % Change

Total global expenses $ 567.3 $ 824.3 (31)% $ 824.3 $ 706.3 17%

CTI restructuring 26.8 22.3 22.3 44.6

FCPA accrual 46.0 89.0 89.0 –

Pension settlement charge 9.5 – – –

Asset impairment and other charges – 117.2 117.2 –

Adjusted total global expenses $ 485.0 $ 595.8 (19)% $ 595.8 $ 661.7 (10)%

Allocated to segments (438.3) (438.4) –% (438.4) (474.2) (8)%

Adjusted net global expenses $ 46.7 $ 157.4 (70)% $ 157.4 $ 187.5 (16)%

Net global expenses(1) $ 129.0 $ 385.9 (67)% $ 385.9 $ 232.1 66%

(1) Net global expenses represents total global expenses less amounts allocated to segments.

Amounts in the table above may not necessarily sum due to rounding.

2014 Compared to 2013

As compared to the prior-year period, total global expenses benefited from a non-cash impairment charge of approximately $117 for

capitalized software related to SMT (discussed below) and the $89 accrual for the settlements related to the FCPA investigations which were

recorded in 2013, partially offset by the additional $46 accrual for the settlements related to the FCPA investigations and settlement charges

associated with the U.S. pension plan (discussed below) which were recorded in 2014.

As a result of the payments made to former employees who are vested and participate in the U.S. pension plan, in the second quarter of

2014, we recorded a settlement charge of approximately $24. Because the settlement threshold was exceeded in the second quarter of

2014, settlement charges of approximately $5 and approximately $7 were also recorded in the third and fourth quarters of 2014,

respectively, as a result of additional payments from our U.S. pension plan. These settlement charges were allocated between Global

Expenses and the operating results of North America. See “Segment Review – North America” in this MD&A for a further discussion of the

settlement charges.

In the fourth quarter of 2013, we decided to halt further roll-out of our SMT project beyond the pilot market of Canada, in light of the

potential risk of further business disruption. As a result, a non-cash impairment charge for the capitalized software associated with SMT was

recorded. See Note 1, Description of the Business and Summary of Significant Accounting Policies on pages F-8 through F-14 of our 2014

Annual Report for more information.

Adjusted total global expenses decreased compared to the prior-year period primarily as a result of cost savings initiatives, including lower

expenses related to our SMT project, and to a lesser extent, lower marketing expenses. In addition, professional and related fees associated

with the FCPA investigations and compliance reviews decreased compared to the prior-year period. Professional and related fees associated

with the FCPA investigations and compliance reviews described in Note 15, Contingencies on pages F-47 through F-49 of our 2014 Annual

Report, amounted to approximately $7 in 2014, as compared to approximately $28 in 2013. These fees were not allocated to the segments.

Although the FCPA investigations and compliance reviews are now complete and we have reached settlements with the government, we

will incur ongoing costs related to the monitor and self-reporting obligations undertaken pursuant to the settlements.

With respect to the global expenses discussion above and below, for all years presented, please see Risk Factors on pages 10 through 11 of

our 2014 Annual Report, and Note 15, Contingencies on pages F-47 through F-49 of our 2014 Annual Report for more information

regarding the FCPA settlements, and other related matters, including our expectations with respect to future professional and related fees

related to the monitor and self-reporting obligations undertaken pursuant to the settlements.

A V O N 2014 51