Avon 2014 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2014 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

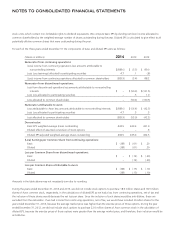

(U.S. dollars in millions, except per share and share data)

NOTE 1. Description of the Business and Summary of Significant Accounting Policies

Business

When used in these notes, the terms “Avon,” “Company,” “we,” “our” or “us” mean Avon Products, Inc.

We are a global manufacturer and marketer of beauty and related products. Our business is conducted worldwide, primarily in one channel,

direct selling. Our reportable segments are based on geographic operations in four regions: Latin America; Europe, Middle East & Africa;

North America; and Asia Pacific. Our product categories are Beauty and Fashion & Home. Beauty consists of skincare (which includes

personal care), fragrance and color (cosmetics). Fashion & Home consists of fashion jewelry, watches, apparel, footwear, accessories, gift and

decorative products, housewares, entertainment and leisure products, children’s products and nutritional products. Sales are made to the

ultimate consumer principally by independent Representatives.

Principles of Consolidation

The consolidated financial statements include the accounts of Avon and our majority and wholly-owned subsidiaries. Intercompany balances

and transactions are eliminated.

Use of Estimates

We prepare our consolidated financial statements and related disclosures in conformity with accounting principles generally accepted in the

United States of America, or GAAP. In preparing these statements, we are required to use estimates and assumptions that affect the

reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the

reported amounts of revenues and expenses during the reporting period. Actual results could differ materially from those estimates and

assumptions. On an ongoing basis, we review our estimates, including those related to allowances for sales returns, allowances for doubtful

accounts receivable, provisions for inventory obsolescence, the determination of discount rate and other actuarial assumptions for pension

and postretirement benefit expenses, restructuring expense, income taxes and tax valuation allowances, share-based compensation, loss

contingencies and the evaluation of goodwill, intangible assets and capitalized software for potential impairment.

Foreign Currency

Financial statements of foreign subsidiaries operating in other than highly inflationary economies are translated at year-end exchange rates

for assets and liabilities and average exchange rates during the year for income and expense accounts. The resulting translation adjustments

are recorded within accumulated other comprehensive loss (“AOCI”). Gains or losses resulting from the impact of changes in foreign

currency rates on assets and liabilities denominated in a currency other than the functional currency are recorded in other expense, net.

For financial statements of Avon subsidiaries operating in highly inflationary economies, the United States (“U.S.”) dollar is required to be

used as the functional currency. At December 31, 2014, Venezuela was the only Avon subsidiary considered to be operating in a highly

inflationary economy. Highly inflationary accounting requires monetary assets and liabilities, such as cash, receivables and payables, to be

remeasured into U.S. dollars at the current exchange rate at the end of each period with the impact of any changes in exchange rates being

recorded in income. We record the impact of changes in exchange rates on monetary assets and liabilities in other expense, net. Similarly,

deferred tax assets and liabilities are remeasured into U.S. dollars at the current exchange rates; however, the impact of changes in exchange

rates is recorded in income taxes in the Consolidated Statements of Income. Non-monetary assets and liabilities, such as inventory, property,

plant and equipment and prepaid expenses are recorded in U.S. dollars at the historical rates at the time of acquisition of such assets or

liabilities.

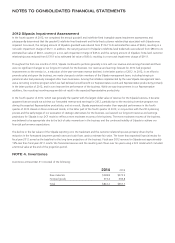

Venezuela Currency

We account for Venezuela as a highly inflationary economy. In February 2014, the Venezuelan government announced a foreign exchange

system (“SICAD II”) which began operating on March 24, 2014. There are multiple legal mechanisms in Venezuela to exchange currency. As

SICAD II represented the rate which better reflected the economics of Avon Venezuela’s business activity, we concluded that we should

utilize the SICAD II exchange rate to remeasure our Venezuelan operations effective March 31, 2014. As a result of the change to the SICAD

II rate, which caused the recognition of a devaluation of approximately 88% as compared to the official exchange rate we used previously,

we recorded an after-tax loss of $41.8 ($53.7 in other expense, net, and a benefit of $11.9 in income taxes) in the first quarter of 2014,

primarily reflecting the write-down of monetary assets and liabilities. In addition, as a result of using the historical U.S. dollar cost basis of

non-monetary assets, such as inventories, these assets continued to be remeasured, following the change to the SICAD II rate, at the