Avon 2014 Annual Report Download - page 123

Download and view the complete annual report

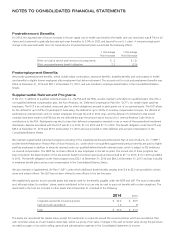

Please find page 123 of the 2014 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.and monitoring of other Plan Fiduciaries. Plaintiffs seek, inter alia, certain monetary relief, damages, and declaratory, injunctive, and other

equitable relief. We are unable to predict the outcome of this matter. However, it is reasonably possible that we may incur a loss in

connection with this matter. We are unable to reasonably estimate the amount or range of such reasonably possible loss.

Under some circumstances, any losses incurred in connection with adverse outcomes in the litigation matters described above could be

material.

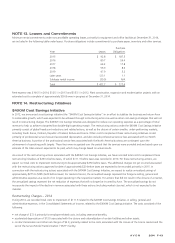

Brazilian Tax Matters

In 2002, our Brazilian subsidiary received an excise tax (IPI) assessment from the Brazilian tax authorities for alleged tax deficiencies during

the years 1997-1998. In December 2012, additional assessments were received for the year 2008 with respect to excise tax (IPI) and taxes

charged on gross receipts (PIS and COFINS). In the second quarter of 2014, the PIS and COFINS assessments were officially closed in favor of

Avon Brazil. The 2002 and the 2012 IPI assessments assert that the establishment in 1995 of separate manufacturing and distribution

companies in Brazil was done without a valid business purpose and that Avon Brazil did not observe minimum pricing rules to define the

taxable basis of excise tax. The structure adopted in 1995 is comparable to that used by many other companies in Brazil. We believe that our

Brazilian corporate structure is appropriate, both operationally and legally, and that the 2002 and 2012 IPI assessments are unfounded.

These matters are being vigorously contested. In January 2013, we filed a protest seeking a first administrative level review with respect to

the 2012 IPI assessment. In July 2013, the 2012 IPI assessment was upheld at the first administrative level and we have appealed this

decision to the second administrative level. The 2012 IPI assessment totals approximately $322, including penalties and accrued interest. In

October 2010, the 2002 IPI assessment was upheld at the first administrative level at an amount reduced to approximately $25 from

approximately $59, including penalties and accrued interest. We have appealed this decision to the second administrative level.

In the event that the 2002 or 2012 IPI assessments are upheld at the last administrative level, it may be necessary for us to provide security

to pursue further appeals, which, depending on the circumstances, may result in a charge to earnings. It is not possible to reasonably

estimate the likelihood or potential amount of assessments that may be issued for subsequent periods (tax years up through 2007 are closed

by statute). However, other similar IPI assessments involving different periods (1998-2001) have been canceled and officially closed in our

favor by the second administrative level, and we believe that the likelihood that the 2002 assessment will be upheld is remote and the

likelihood that the 2012 IPI assessment will be upheld is reasonably possible. As stated above, we believe that the 2002 and 2012 IPI

assessments are unfounded.

Other Matters

Various other lawsuits and claims, arising in the ordinary course of business or related to businesses previously sold, are pending or

threatened against Avon. In management’s opinion, based on its review of the information available at this time, the total cost of resolving

such other contingencies at December 31, 2014, is not expected to have a material adverse effect on our consolidated financial position,

results of operations or cash flows.

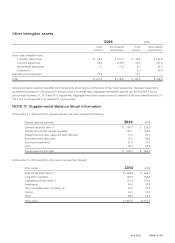

NOTE 16. Goodwill and Intangible Assets

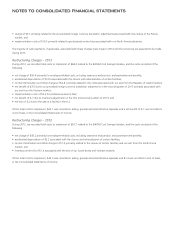

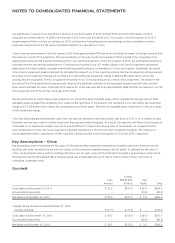

Q3 2012 China Impairment Assessment

Based on the continued decline in revenue performance in China during the third quarter of 2012 and a corresponding lowering of our

long-term growth estimates in China, we completed an interim impairment assessment of the fair value of goodwill related to our

operations in China. The changes to our long-term growth estimates were based on the state of our China business, as the China business

did not achieve our revenue, earnings and cash flows expectations primarily due to challenges in our business model. Based upon this

interim analysis, we determined that the goodwill related to our operations in China was impaired. Specifically, the results of our interim

impairment test indicated the estimated fair value of our China reporting unit was less than its respective carrying amount. As a result of our

impairment testing, we recorded a non-cash impairment charge of $44.0 ($44.0 after tax) in the third quarter of 2012 to reduce the carrying

amount of goodwill for China to its estimated fair value.

Q3 2013 China Impairment Assessment

As compared to our projections used in our fourth quarter 2012 impairment analysis (“Q4 2012 projections”), China performed generally in

line with our revenue and earnings projections during the first half of 2013. As assumed in our Q4 2012 projections, China’s revenue in the

first half of 2013 continued to deteriorate versus the prior-year period; however, beginning in the third quarter of 2013, this revenue decline

A V O N 2014 F-49