Avon 2014 Annual Report Download - page 121

Download and view the complete annual report

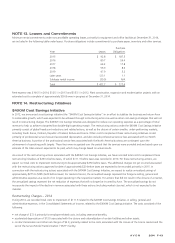

Please find page 121 of the 2014 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In addition, during 2014 we recorded total costs to implement of $1.1 and during 2013 a net benefit as a result of adjustments to the

reserve of $7.5 primarily in selling, general and administrative expenses, in the Consolidated Statements of Income, associated with the

restructuring programs launched in 2005 and 2009, which are substantially complete. The net benefit in 2013 primarily consisted of a net

gain of $4.9 due to the sale of a facility in the U.S., as well as adjustments to the reserve for employee-related costs. During 2012, we

recorded total costs to implement of $.1, of which a net benefit of $3.0 was recorded in selling, general and administrative expenses and

total costs to implement of $3.1 were recorded in cost of sales, in the Consolidated Statements of Income, associated with the restructuring

programs launched in 2005 and 2009. The total costs to implement in 2012 consisted of the following:

• net benefit of $12.1 as a result of adjustments to the reserve, partially offset by employee-related costs;

• implementation costs of $8.9 for professional service fees, primarily associated with our initiatives to outsource certain finance processes

and realign certain distribution operations;

• accelerated depreciation of $4.7 associated with our initiatives to realign certain distribution operations and close certain manufacturing

operations; and

• a net gain of $1.4 due to the sale of machinery and equipment in Germany.

NOTE 15. Contingencies

Settlements of FCPA Investigations

As previously reported, we engaged outside counsel to conduct an internal investigation and compliance reviews focused on compliance

with the FCPA and related U.S. and foreign laws in China and additional countries. The internal investigation, which was conducted under

the oversight of our Audit Committee, began in June 2008. The internal investigation and compliance reviews focused on reviewing certain

expenses and books and records processes, including, but not limited to, travel, entertainment, gifts, use of third-party vendors and

consultants and related due diligence, joint ventures and acquisitions, and payments to third-party agents and others, in connection with our

business dealings, directly or indirectly, with foreign governments and their employees. The internal investigation and compliance reviews of

these matters are complete. In connection with the internal investigation and compliance reviews, certain personnel actions, including

termination of employment of certain senior members of management, were taken. In connection with the internal investigation and

compliance reviews, we have enhanced our ethics and compliance program, including our policies and procedures, FCPA compliance-related

training, FCPA third-party due diligence program and other compliance-related resources.

As previously reported, in October 2008, we voluntarily contacted the SEC and the DOJ to advise both agencies of our internal investigation.

We cooperated with investigations of these matters by the SEC and the DOJ.

As previously reported, in December 2014, the United States District Court for the Southern District of New York (the “USDC”) approved a

deferred prosecution agreement (the “DPA”) entered into between the Company and the DOJ related to charges of violations of the books

and records and internal controls provisions of the FCPA. In addition, Avon Products (China) Co. Ltd., a subsidiary of the Company operating

in China, pleaded guilty to conspiring to violate the books and records provision of the FCPA and was sentenced by the USDC to pay a $68

fine. The SEC also filed a complaint against the Company charging violations of the books and records and internal controls provisions of the

FCPA and a consent to settlement (the “Consent”) which was approved in a judgment entered by the USDC in January 2015, and included

$67 in disgorgement and prejudgment interest. The DPA, the above-mentioned guilty plea and the Consent resolved the SEC’s and the

DOJ’s investigations of the Company’s compliance with the FCPA and related U.S. laws in China and additional countries. The fine was paid

in December 2014 and the payment to the SEC was made in January 2015, both of which had been previously accrued for before

December 31, 2014.

Under the DPA, the DOJ will defer criminal prosecution of the Company for a term of three years. If the DOJ determines that the Company

has knowingly violated the DPA, the DOJ may commence prosecution or extend the term of the DPA, including the monitoring provisions

described below, for up to one year. If the Company remains in compliance with the DPA during its term, the charges against the Company

will be dismissed with prejudice.

Under the DPA and the Consent, among other things, the Company agreed to have a compliance monitor (the “monitor”). With the

approval of the DOJ and the SEC, the monitor can be replaced 18 months after the monitor’s retention by the Company pursuant to its

agreement to undertake self-reporting obligations for the remainder of the monitoring period. The monitoring period expires on the later of

three years from the date of the retention of the monitor and the expiration of the DPA. We are in the process of retaining a monitor,

whose selection is subject to the approval of the DOJ and the SEC. There can be no assurance as to when a monitor will be approved or

whether or when the DOJ and the SEC will approve replacing the monitorship with the Company’s self-reporting.

A V O N 2014 F-47