Avon 2014 Annual Report Download - page 43

Download and view the complete annual report

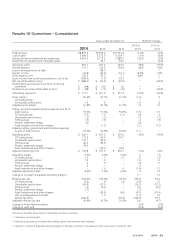

Please find page 43 of the 2014 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The decrease of 70 basis points in Adjusted gross margin was primarily due to the following:

• a decrease of approximately 130 basis points due to the unfavorable impact of foreign currency transaction losses and foreign currency

translation, driven by Europe, Middle East & Africa and Latin America; and

• an increase of 80 basis points due to the favorable net impact of mix and pricing, primarily in Latin America, which includes the realization

of price increases in markets experiencing relatively high inflation (Venezuela and Argentina).

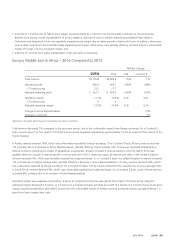

Selling, General and Administrative Expenses

Selling, general and administrative expenses for 2014 decreased approximately $761 compared to 2013. This decrease is primarily due to

the favorable impact of foreign currency translation, as the strengthening of the U.S. dollar against many of our foreign currencies resulted

in lower reported selling, general and administrative expenses. The decrease in selling, general and administrative expenses is also due to a

non-cash impairment charge of approximately $117 for capitalized software related to SMT recorded in 2013 that did not recur in 2014, the

$89 accrual for the settlements relating to the FCPA investigations recorded in 2013, lower expenses related to our SMT project as a result

of our decision to halt the further roll-out beyond the pilot market of Canada in the fourth quarter of 2013, lower fixed expenses primarily

resulting from our cost savings initiatives, lower net brochure costs, lower Representative and sales leader expense, lower bad debt expense

and lower professional and related fees associated with the FCPA investigation and compliance reviews. Partially offsetting the decrease in

selling, general and administrative expenses was a higher amount of CTI restructuring primarily associated with the $400M Cost Savings

Initiative, the additional $46 accrual recorded in the first quarter of 2014 for the settlements related to the FCPA investigations and the

approximate $36 aggregate settlement charges recorded in 2014 associated with the payments made to former employees who are vested

and participate in the U.S. pension plan.

Selling, general and administrative expenses and Adjusted selling, general and administrative expenses as a percentage of revenue decreased

150 basis points and 110 basis points, respectively, compared to 2013. Selling general and administrative expenses as a percentage of

revenue was impacted by a higher amount of CTI restructuring as compared to the prior-year period. Additionally, in the current-year period,

selling, general and administrative expenses as a percentage of revenue was impacted by the additional $46 accrual recorded in the first

quarter of 2014 for the settlements related to the FCPA investigations, the approximate $36 aggregate settlement charges recorded in 2014

associated with the payments made to former employees who are vested and participate in the U.S. pension plan, and approximately $16

associated with our Venezuela operations for certain non-monetary assets carried at the historical U.S. dollar cost following a devaluation. In

the prior-year period, selling, general and administrative expenses as a percentage of revenue was impacted by a non-cash impairment

charge of $117 for capitalized software related to SMT, the $89 accrual for the settlements relating to the FCPA investigations and $5

associated with our Venezuela operations for certain non-monetary assets carried at the historical U.S. dollar cost following a devaluation.

See Note 14, Restructuring Initiatives, on pages F-43 through F-47 of our 2014 Annual Report for more information on CTI restructuring,

Note 1, Description of the Business and Summary of Significant Accounting Policies on pages F-8 through F-14 of our 2014 Annual Report

for more information on SMT, Note 15, Contingencies on pages F-47 through F-49 of our 2014 Annual Report for more information on the

FCPA investigations, “Segment Review – Global and Other Expenses” in this MD&A and Note 11, Employee Benefit Plans on pages F-32

through F-40 of our 2014 Annual Report for a further discussion of the pension settlement charges and “Segment Review – Latin America”

in this MD&A for a further discussion of Venezuela.

The decrease of 110 basis points in Adjusted selling, general and administrative expenses as a percentage of revenue was primarily due to

the following:

• a decrease of 50 basis points from lower expenses related to our SMT project as a result of our decision to halt the further roll-out beyond

the pilot market of Canada in the fourth quarter of 2013;

• a decrease of 40 points due to lower fixed expenses primarily resulting from our cost savings initiatives, mainly reductions in headcount

that were associated with the $400M Cost Savings Initiative;

• a decrease of 30 basis points as a result of the net impact of the incremental tax credits in Brazil recognized as revenue in 2014 and 2013;

• a decrease of 30 basis points from lower net brochure costs, primarily in North America and Latin America;

• a decrease of 30 basis points from lower Representative and sales leader expense, primarily in North America and Latin America;

• a decrease of 30 basis points from lower bad debt expense; and

• a decrease of 20 basis points from lower professional and related fees associated with the FCPA investigation and compliance reviews.

A V O N 2014 35