Avon 2014 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2014 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

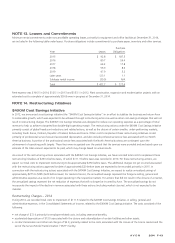

As noted previously, we expect to record total costs to implement restructuring of approximately $250 before taxes under the $400M Cost

Savings Initiative. The amounts shown in the tables above as charges recorded to-date relate to initiatives that have been approved and

recorded in the financial statements as the costs are probable and estimable. The amounts shown in the tables above as total expected

charges on approved initiatives represent charges recorded to-date plus charges yet to be recorded for approved initiatives as the relevant

accounting criteria for recording an expense have not yet been met. In addition to the charges included in the tables above, we have

incurred and will incur other costs to implement restructuring initiatives such as other professional services and accelerated depreciation.

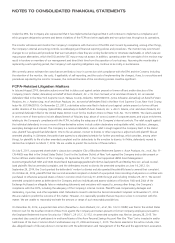

Additional Restructuring Charges 2012

In an effort to improve operating performance, we identified certain actions in 2012 that we believe will enhance our operating model,

reduce costs and improve efficiencies. In addition, we have relocated our corporate headquarters in New York City.

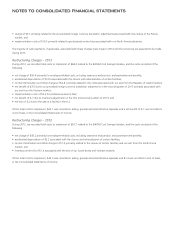

Restructuring Charges – 2014

As a result of the analysis and the actions taken, during 2014, we recorded total costs to implement of $1.8 in selling, general and

administrative expenses, in the Consolidated Statements of Income, primarily consisting of contract termination costs associated with the

relocation of our corporate headquarters.

Restructuring Charges – 2013

As a result of the analysis and the actions taken, during 2013, we recorded total costs to implement of $5.0 in selling, general and

administrative expenses in the Consolidated Statements of Income, primarily consisting of contract termination costs of $6.1 associated with

the relocation of our corporate headquarters, partially offset by other immaterial adjustments to the reserve for employee-related costs.

Restructuring Charges – 2012

During 2012, we recorded total costs to implement of $73.9, in selling, general and administrative expenses, in the Consolidated Statements

of Income. The costs consisted of the following:

• net charge of $53.4 primarily for employee-related costs, including severance and pension benefits;

• contract termination costs of $12.0 associated with the relocation of our corporate headquarters;

• implementation costs of $5.8 for professional service fees; and

• accelerated depreciation of $2.7 associated with the relocation of our corporate headquarters.

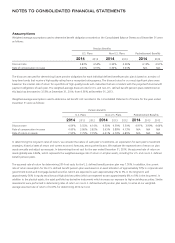

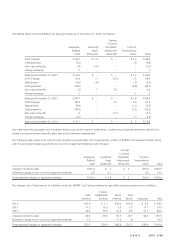

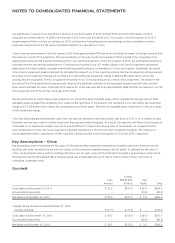

The liability balance for these various restructuring initiatives as of December 31, 2014 is as follows:

Employee-

Related

Costs

Contract

Terminations/

Other Total

2012 Charges $ 53.4 $12.0 $ 65.4

Cash payments (33.9) (.2) (34.1)

Non-cash write-offs (1.6) – (1.6)

Foreign exchange (.3) – (.3)

Balance at December 31, 2012 $ 17.6 $11.8 $ 29.4

2013 Charges .8 6.1 6.9

Adjustments (1.9) – (1.9)

Cash payments (14.4) (5.6) (20.0)

Foreign exchange (.1) – (.1)

Balance at December 31, 2013 $ 2.0 $12.3 $ 14.3

2014 Charges – 1.9 1.9

Adjustments (.1) – (.1)

Cash payments (1.5) (5.7) (7.2)

Balance at December 31, 2014 $ .4 $ 8.5 $ 8.9

The actions associated with these various restructuring initiatives are substantially complete.