Avon 2014 Annual Report Download - page 95

Download and view the complete annual report

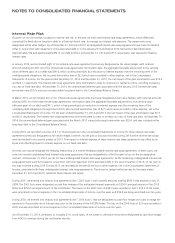

Please find page 95 of the 2014 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Foreign exchange net loss of $18.2 for 2014 and net gains of $.2 and $7.7 for 2013 and 2012, respectively, resulting from the translation of

actuarial losses and prior service cost recorded in AOCI are included in changes in foreign currency translation adjustments in the

Consolidated Statements of Comprehensive Income.

NOTE 7. Income Taxes

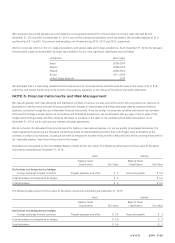

At December 31, 2014, we had recognized deferred tax assets relating to tax loss carryforwards of $726.2 primarily from foreign

jurisdictions, for which a valuation allowance of $717.9 has been provided. Prior to December 31, 2014, we had recognized deferred tax

assets of $617.7 relating to excess U.S. foreign tax credit carryforwards that will expire in the 2018-2024 period.

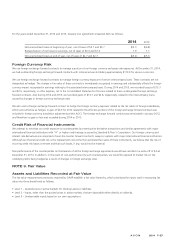

During the fourth quarter of 2012, as a result of the uncertainty of our financing arrangements and our domestic liquidity profile at that

time, we determined that we may repatriate offshore cash to meet certain domestic funding needs. Accordingly, we asserted that these

undistributed earnings of foreign subsidiaries were no longer indefinitely reinvested and, therefore, recorded an additional provision for

income taxes of $168.3 on such earnings. At December 31, 2012, we had a deferred tax liability in the amount of $224.8 for the U.S. tax

cost on the undistributed earnings of subsidiaries outside of the U.S. of $3.1 billion.

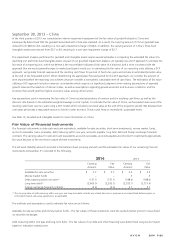

At December 31, 2014, we continue to assert that our foreign earnings are not indefinitely reinvested, as a result of our domestic liquidity

profile. Accordingly, we adjusted our deferred tax liability to account for our 2014 undistributed earnings of foreign subsidiaries and for

earnings that were actually repatriated to the U.S. during the year. Additionally, the deferred tax liability was reduced due to the lower cost

to repatriate the undistributed earnings of our foreign subsidiaries compared to 2013. The net impact on the deferred tax liability associated

with the Company’s undistributed earnings is a reduction of $128.5, resulting in a deferred tax liability balance of $14.3 related to the

incremental tax cost on $1.9 billion of undistributed foreign earnings at December 31, 2014. This deferred income tax liability amount is net

of the estimated foreign tax credits that would be generated upon the repatriation of such earnings. The repatriation of foreign earnings

should result in the utilization of foreign tax credits in the year of repatriation; therefore, the utilization of foreign tax credits is dependent on

the amount and timing of repatriations, as well as the jurisdictions involved. We have not included the undistributed earnings of our

subsidiary in Venezuela in the calculation of this deferred income tax liability as local regulations restrict cash distributions denominated in

U.S. dollars.

A V O N 2014 F-21