Avon 2014 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2014 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Restructuring Expense

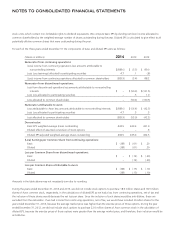

We record the estimated expense for our restructuring initiatives when such costs are deemed probable and estimable, when approved by

the appropriate corporate authority and by accumulating detailed estimates of costs for such plans. These expenses include the estimated

costs of employee severance and related benefits, impairment or accelerated depreciation of property, plant and equipment and capitalized

software, and any other qualifying exit costs. Such costs represent our best estimate, but require assumptions about the programs that may

change over time, including attrition rates. Estimates are evaluated periodically to determine whether an adjustment is required.

Pension and Postretirement Expense

Pension and postretirement expense is determined based on a number of actuarial assumptions, which are generally reviewed and

determined on an annual basis. These assumptions include discount rates, hybrid plan maximum interest crediting rates and expected rate of

return on plan assets, rate of compensation increase of plan participants, interest cost, health care cost trend rates, benefits earned,

mortality rates, the number of participants and certain demographics and other factors. Actual results that differ from assumptions are

accumulated and amortized to expense over future periods and, therefore, generally affect recognized expense in future periods. We are

required, among other things, to recognize the funded status of pension and other postretirement benefit plans on the Consolidated

Balance Sheets. Each overfunded plan is recognized as an asset and each underfunded plan is recognized as a liability. The recognition of

prior service costs or credits and net actuarial gains or losses, as well as subsequent changes in the funded status, are recognized as

components of AOCI, net of tax, in shareholders’ equity, until they are amortized as a component of net periodic benefit cost. We recognize

prior service costs or credits and actuarial gains and losses beyond a 10% corridor to earnings based on the estimated future service period

of the participants. The determination of the 10% corridor utilizes a calculated value of plan assets for our more significant plans, whereby

gains and losses are smoothed over three- and five-year periods. We use a December 31 measurement date for all of our employee benefit

plans.

Contingencies

We determine whether to disclose and/or accrue for loss contingencies based on an assessment of whether the risk of loss is remote,

reasonably possible or probable. We record loss contingencies when it is probable that a liability has been incurred and the amount of loss is

reasonably estimable.

Revisions

During the first quarter of 2014, we revised our consolidated financial statements to reflect tooling balances in other assets, while they had

been previously reported in inventories, as we believe that this is a better presentation of our tooling assets. Tooling assets are the plates and

molds used in the manufacturing process of our beauty products. This revision did not impact cash flows from operating activities, our

Consolidated Statements of Income, our Consolidated Statements of Comprehensive Income or our Consolidated Statements of Changes in

Shareholders’ Equity. We determined that the effect of this revision was not material to any of our previously issued financial statements.

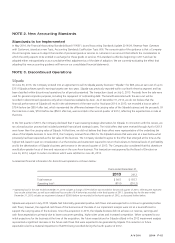

Out-of-Period Items

During 2014, we recorded out-of-period adjustments in our Latin America segment (primarily related to revenue and selling, general and

administrative expenses) which increased earnings by approximately $15 before tax. The total out-of-period adjustments increasing earnings

during 2014 was approximately $13 before tax (approximately $1 after tax decreasing earnings during 2014). We evaluated the total out-of-

period adjustments impacting 2014, both individually and in the aggregate, in relation to the quarterly and annual periods in which they

originated and the annual period in which they were corrected, and concluded that these adjustments were not material to the consolidated

annual financial statements for all impacted periods.

During the first quarter of 2012, we recorded an out-of-period adjustment which decreased earnings by approximately $14 before tax ($10

after tax) which related to 2011 and was associated with bad debt expense in our South Africa operations. We evaluated the total out-of-

period adjustments impacting 2012 of approximately $13 before tax (approximately $15 after tax), both individually and in the aggregate, in

relation to the quarterly and annual periods in which they originated and the annual period in which they were corrected, and concluded

that these adjustments were not material to the consolidated annual financial statements for all impacted periods.

(Loss) Earnings per Share

We compute (loss) earnings per share (“EPS”) using the two-class method, which is a (loss) earnings allocation formula that determines (loss)

earnings per share for common stock and participating securities. Our participating securities are our grants of restricted stock and restricted

A V O N 2014 F-13