Avon 2014 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2014 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTE 13. Leases and Commitments

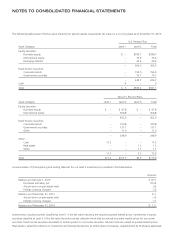

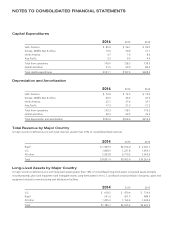

Minimum rental commitments under noncancellable operating leases, primarily for equipment and office facilities at December 31, 2014,

are included in the following table under leases. Purchase obligations include commitments to purchase paper, inventory and other services.

Year Leases

Purchase

Obligations

2015 $ 92.8 $ 187.3

2016 80.7 59.4

2017 64.2 17.8

2018 53.9 8.6

2019 47.9 3.2

Later years 123.1 1.1

Sublease rental income (39.9) N/A

Total $ 422.7 $ 277.4

Rent expense was $106.5 in 2014, $125.1 in 2013 and $133.1 in 2012. Plant construction, expansion and modernization projects with an

estimated cost to complete of approximately $59.8 were in progress at December 31, 2014.

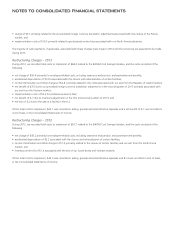

NOTE 14. Restructuring Initiatives

$400M Cost Savings Initiative

In 2012, we announced a cost savings initiative (the “$400M Cost Savings Initiative”) in an effort to stabilize the business and return Avon

to sustainable growth, which was expected to be achieved through restructuring actions as well as other cost-savings strategies that will not

result in restructuring charges. The $400M Cost Savings Initiative was designed to reduce our operating expenses as a percentage of total

revenue to help us achieve a targeted low double-digit operating margin. The restructuring actions under the $400M Cost Savings Initiative

primarily consist of global headcount reductions and related actions, as well as the closure of certain smaller, under-performing markets,

including South Korea, Vietnam, Republic of Ireland, Bolivia and France. Other costs to implement these restructuring initiatives consist

primarily of professional service fees and accelerated depreciation, and also include professional service fees associated with our North

America business. A portion of the professional service fees associated with the North America business are contingent upon the

achievement of operating profit targets. These fees were recognized over the period that the services were provided and are based upon our

estimate of the total amount expected to be paid, which may change based on actual results.

As a result of the restructuring actions associated with the $400M Cost Savings Initiative, we have recorded total costs to implement these

restructuring initiatives of $230.4 before taxes, of which $111.3 before taxes was recorded in 2014. For these restructuring actions, we

expect our total costs to implement restructuring to be approximately $250 before taxes. The additional charges not yet incurred associated

with the restructuring actions approved to-date of approximately $20 before taxes are expected to be recorded primarily in 2015. In

connection with the restructuring actions associated with the $400M Cost Savings Initiative, we expect to realize annualized savings of

approximately $275 to $285 (both before taxes). For market closures, the annualized savings represent the foregone selling, general and

administrative expenses as a result of no longer operating in the respective markets. For actions that did not result in the closure of a market,

the annualized savings represent the net reduction of expenses that will no longer be incurred by Avon. The annualized savings do not

incorporate the impact of the decline in revenue associated with these actions (including market closures), which is not expected to be

material.

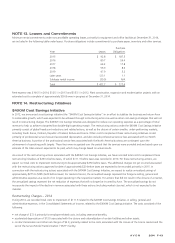

Restructuring Charges – 2014

During 2014, we recorded total costs to implement of $111.3 related to the $400M Cost Savings Initiative, in selling, general and

administrative expenses, in the Consolidated Statements of Income, related to the $400M Cost Savings Initiative. The costs consisted of the

following:

• net charge of $72.0 primarily for employee-related costs, including severance benefits;

• accelerated depreciation of $13.0 associated with the closure and rationalization of certain facilities and other assets;

• contract termination and other net charges of $6.3, primarily related to the costs associated with the closure of the France market and the

exit of the Service Model Transformation (“SMT”) facility;

A V O N 2014 F-43