Avon 2014 Annual Report Download - page 127

Download and view the complete annual report

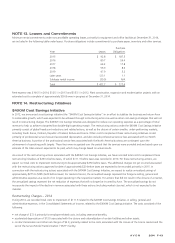

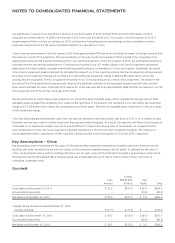

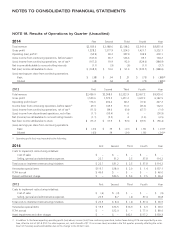

Please find page 127 of the 2014 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In addition, income (loss) from continuing operations, before taxes during 2013 was impacted by a one-time, after-tax loss of $50.7 ($34.1 in other

expense, net, and $16.6 in income taxes) recorded in the first quarter, primarily reflecting the write-down of monetary assets and liabilities and deferred tax

benefits due to the devaluation of Venezuelan currency. Income (loss) from continuing operations, before taxes during 2013 was also impacted by a losson

extinguishment of debt of $73.0 before tax in the first quarter of 2013 caused by the make-whole premium and the write-off of debt issuance costs

associated with the prepayment of our Private Notes (as defined in Note 5, Debt and Other Financing), as well as the write-off of debt issuance costs

associated with the early repayment of $380.0 of the outstanding principal amount of the term loan agreement (as defined in Note 5, Debt and Other

Financing). In addition, income (loss) from continuing operations, before taxes during 2013 was impacted by a loss on extinguishment of debt of $13.0

before tax in the second quarter of 2013 caused by the make-whole premium and the write-off of debt issuance costs and discounts, partially offset by a

deferred gain associated with the January 2013 interest-rate swap agreement termination, associated with the prepayment of the 2014 Notes (as defined in

Note 5, Debt and Other Financing).

(3) (Loss) income from continuing operations, net of tax during 2014 was negatively impacted by a non-cash income tax charge of $404.9. This was primarily

due to a valuation allowance of $383.5 to reduce our deferred tax assets to an amount that is “more likely than not” to be realized, which was recorded in

the fourth quarter of 2014. In addition, (loss) income from continuing operations, net of tax during 2014 was favorably impacted by the $18.5 net tax

benefit recorded in the fourth quarter of 2014 related to the finalization of the FCPA settlements.

In addition, (loss) income from continuing operations, net of tax during 2013 was impacted by valuation allowances for deferred tax assets of $41.8 related

to Venezuela in the fourth quarter of 2013 and $9.2 related to the China business in the third quarter of 2013.

(4) The sum of per share amounts for the quarters does not necessarily equal that for the year because the computations were made independently.

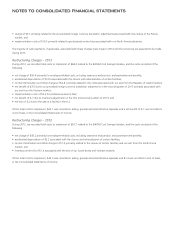

See Note 15, Restructuring Initiatives, “Results Of Operations – Consolidated” within MD&A on pages 33 through 40, “Segment Review –

Latin America” within MD&A on pages 40 through 45, Note 15, Contingencies, Note 11, Employee Benefit Plans, Note 16, Goodwill and

Intangibles, Note 1, Description of the Business and Summary of Significant Accounting Policies, Note 5, Debt and Other Financing and

Note 7, Income Taxes, for more information on these items.

A V O N 2014 F-53