Avon 2014 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2014 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

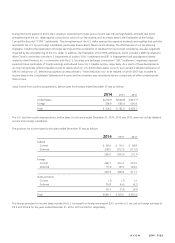

Ba1 (Stable outlook) (as discussed below), the interest rates on the Notes will increase by .50%, effective as of March 15, 2015. The carrying

value of the 2016 Notes represented the $250.0 principal amount, net of the unamortized discount to face value of $.1 and $.1 at

December 31, 2014 and 2013, respectively. The carrying value of the 2020 Notes represented the $500.0 principal amount, net of the

unamortized discount to face value of $.6 and $.7 at December 31, 2014 and 2013, respectively. The carrying value of the 2023 Notes

represented the $500.0 principal amount, net of the unamortized discount to face value of $4.0 and $4.5 at December 31, 2014 and 2013,

respectively. The carrying value of the 2043 Notes represented the $250.0 principal amount, net of the unamortized discount to face value

of $.7 and $.7 at December 31, 2014 and 2013, respectively.

At December 31, 2014, we also had outstanding $250.0 principal amount of our 5.75% Notes due March 1, 2018 (the “2018 Notes”),

$250.0 principal amount of our 4.20% Notes due July 15, 2018 (the “4.20% Notes”) and $350.0 principal amount of our 6.50% Notes due

March 1, 2019 (the “2019 Notes”). Interest on the 2018 Notes, the 4.20% Notes and the 2019 Notes is payable semi-annually. The carrying

value of the 2018 Notes represented the $250.0 principal amount, net of the unamortized discount to face value of $.3 and $.4 at

December 31, 2014 and 2013, respectively. The carrying value of the 4.20% Notes represented the $250.0 principal amount, net of the

unamortized discount to face value of $.3 and $.4 at December 31, 2014 and 2013, respectively. The carrying value of the 2019 Notes

represented the $350.0 principal amount, net of the unamortized discount to face value of $1.8 and $2.3 at December 31, 2014 and 2013,

respectively.

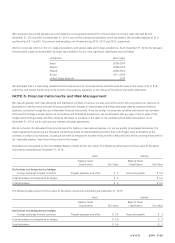

The indentures governing our outstanding notes described above contain certain covenants, including limitations on the incurrence of liens

and restrictions on the incurrence of sale/leaseback transactions and transactions involving a merger, consolidation or sale of substantially all

of our assets. In addition, these indentures contain customary events of default and cross-default provisions. Further, we would be required

to make an offer to repurchase the 2018 Notes, the 2019 Notes and each series of the Notes at a price equal to 101% of their aggregate

principal amount plus accrued and unpaid interest in the event of a change in control involving Avon and a corresponding credit ratings

downgrade to below investment grade. In addition, the indenture governing the Notes contains interest rate adjustment provisions

depending on our credit ratings with S&P and Moody’s. As described in the indenture, the interest rates on the Notes increase by .25% for

each one-notch downgrade below investment grade on each of our long-term credit ratings by S&P or Moody’s. These adjustments are

limited to a total increase of 2% above the respective interest rates in effect on the date of issuance of the Notes. As a result of the long-

term credit rating downgrades by S&P to BB+ (Stable outlook) and by Moody’s to Ba1 (Stable outlook) (as discussed below), the interest

rates on the Notes will increase by .50%, effective as of March 15, 2015.

Term Loan Agreement

On June 29, 2012, we entered into a $500.0 term loan agreement (the “term loan agreement”). Subsequently on August 2, 2012, we

borrowed an incremental $50.0 of principal from subscriptions by new lenders under the term loan agreement. Borrowings under the term

loan agreement bore interest, at our option, at a rate per annum equal to LIBOR plus an applicable margin or a floating base rate plus an

applicable margin, in each case subject to adjustment based on our credit ratings.

In March 2013, we repaid $380.0 of the outstanding principal amount of the term loan agreement with a portion of the proceeds from the

issuance of the Notes, which repayment resulted in a loss in the first quarter of 2013 of $1.6 on extinguishment of debt associated with the

write-off of debt issuance costs related to the term loan agreement. On July 25, 2013, we prepaid $117.5 of the outstanding principal

balance under the term loan agreement, without prepayment penalties. On June 30, 2014, we paid the $52.5 remaining outstanding

principal balance under the term loan agreement, of which $39.4 was not yet due, without prepayment penalties, effectively terminating

the term loan agreement since amounts thereunder may not be reborrowed.

Private Notes

On March 29, 2013, we prepaid the $535.0 senior notes issued in 2010 in a private placement exempt from registration under the Securities

Act of 1933, as amended (the “Private Notes”). In connection with the prepayment of our Private Notes, we incurred a loss on

extinguishment of debt of $71.4 in the first quarter of 2013, which included a make-whole premium of $68.0 and the write-off of $3.4 of

debt issuance costs related to the Private Notes.