Avon 2014 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2014 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

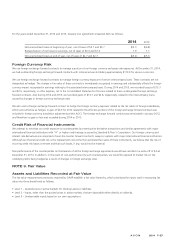

Foreign exchange forward contracts – The fair values of forward contracts were estimated based on quoted forward foreign exchange prices

at the reporting date.

NOTE 10. Share-Based Compensation Plans

The Avon Products, Inc. 2010 Stock Incentive Plan (the “2010 Plan”) and the Avon Products, Inc. 2013 Stock Incentive Plan (the “2013

Plan”), which are shareholder approved plans, provide for several types of share-based incentive compensation awards including stock

options, stock appreciation rights, restricted stock, restricted stock units and performance restricted stock units. Following shareholder

approval of the 2013 Plan in May 2013, there were no further awards made under the 2010 Plan. Under the 2010 Plan, the maximum

number of shares that may be awarded was 32,000,000 shares, where the maximum number of shares was reduced as follows: (i) in the

case of the grant of an award of an option or Stock Appreciation Right (“SAR”), by each share of stock subject to such an award and (ii) in

the case of the grant of an award payable in stock other than an option or SAR by 2.33 multiplied by each share of stock subject to such

award. Under the 2013 Plan, the maximum number of shares that may be awarded is 42,000,000 shares, where the maximum number of

shares are reduced as follows: (i) in the case of the grant of an award of an option or SAR, by each share subject to such an award and (ii) in

the case of the grant of an award payable in shares other than an option or SAR by 3.13 multiplied by each share subject to such an award.

Shares issued under share-based awards will be primarily funded with issuance of new shares.

We have issued stock options and stock appreciation rights under the 2010 Plan, and restricted stock units and performance restricted stock

units under both the 2010 Plan and the 2013 Plan. Stock option awards are granted with an exercise price equal to the closing market price

of our stock at the date of grant. Those option awards and stock appreciation rights generally vest in thirds over the three-year period

following each option grant date and have ten-year contractual terms. Restricted stock units granted to Associates generally vest and settle

after three years. Restricted stock units awarded to non-management directors vest in approximately one year and settle upon a director’s

departure from the Board of Directors. Performance restricted stock units generally vest after three years only upon the satisfaction of certain

performance conditions.

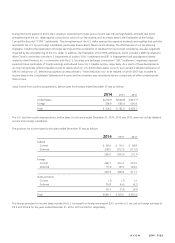

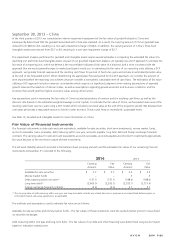

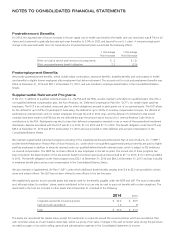

For the years ended December 31:

2014 2013 2012

Compensation cost for stock options, stock appreciation rights, performance

restricted stock units and restricted stock units $38.9 $43.3 $41.1

Total income tax benefit recognized for share-based arrangements 3.2 14.9 13.0

All of the compensation cost for stock options, stock appreciation rights, performance restricted stock units and restricted stock units for

2014, 2013 and 2012 was recorded in selling, general and administrative expenses in the Consolidated Statements of Income.

Stock Options

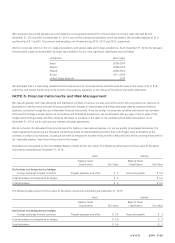

The fair value of each option is estimated on the date of grant using a Black-Scholes-Merton option-pricing model with the following

weighted-average assumptions for options granted during the years ended December 31:

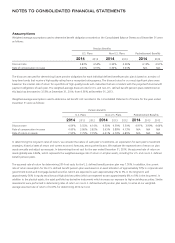

2014 2013 2012

Risk-free rate(1) * * .7%

Expected term(2) * * 4 years

Expected volatility(3) * * 38%

Expected dividends(4) * * 5.0%

* There were no stock options granted in 2014 and 2013.

(1) The risk-free rate was based upon the rate on a zero coupon U.S. Treasury bill, for periods within the contractual life of the option, in effect at the timeof

grant.

(2) The expected term of the option was based on historical employee exercise behavior, the vesting terms of the respective option and a contractual life of10

years.

(3) Expected volatility was based on the weekly historical volatility of our stock price, over a period similar to the expected life of the option.

(4) Assumed the then-current cash dividends of $.23 during 2012 per share each quarter on our common stock for options granted during that year.