Avon 2013 Annual Report Download - page 97

Download and view the complete annual report

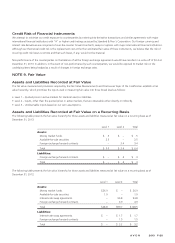

Please find page 97 of the 2013 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• Changes in the fair value of a derivative that is designated as a cash flow hedge are recorded in AOCI to the extent effective and

reclassified into earnings in the same period or periods during which the transaction hedged by that derivative also affects earnings.

• Changes in the fair value of a derivative that is designated as a hedge of a net investment in a foreign operation are recorded in foreign

currency translation adjustments within AOCI to the extent effective as a hedge.

• Changes in the fair value of a derivative not designated as a hedging instrument are recognized in earnings in other expense, net in the

Consolidated Statements of Income.

Realized gains and losses on a derivative are reported in the Consolidated Statements of Cash Flows consistent with the underlying hedged

item.

For derivatives designated as hedges, we assess, both at the hedge’s inception and on an ongoing basis, whether the derivatives that are

used in hedging transactions are highly effective in offsetting changes in fair values or cash flows of hedged items. Highly effective means

that cumulative changes in the fair value of the derivative are between 80% – 125% of the cumulative changes in the fair value of the

hedged item. The ineffective portion of a derivative’s gain or loss, if any, is recorded in earnings in other expense, net in the Consolidated

Statements of Income. In addition, when we determine that a derivative is not highly effective as a hedge, hedge accounting is discontinued.

When it is probable that a hedged forecasted transaction will not occur, we discontinue hedge accounting for the affected portion of the

forecasted transaction, and reclassify gains or losses that were accumulated in AOCI to earnings in other expense, net in the Consolidated

Statements of Income.

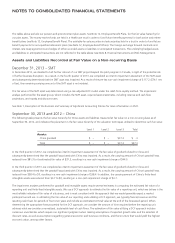

Interest Rate Risk

A portion of our borrowings is subject to interest rate risk. In the past we have used interest-rate swap agreements, which effectively

converted the fixed rate on long-term debt to a floating interest rate, to manage our interest rate exposure. The agreements were

designated as fair value hedges. At December 31, 2012, we held interest-rate swap agreements that effectively converted approximately

62% of our outstanding long-term, fixed-rate borrowings to a variable interest rate based on LIBOR. As of December 31, 2013, all

designated interest-rate swap agreements have been terminated either in conjunction with repayment of the associated debt or in the

January 2013 and March 2012 transactions described below. Our total exposure to floating interest rates was approximately 8% at

December 31, 2013 and 69% at December 31, 2012.

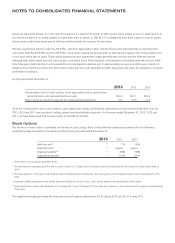

In January 2013, we terminated eight of our interest-rate swap agreements designated as fair value hedges, with notional amounts totaling

$1,000. As of the interest-rate swap agreements’ termination date, the aggregate favorable adjustment to the carrying value (deferred gain)

of our debt was $90.4, which is being amortized as a reduction to interest expense over the remaining term of the underlying debt

obligations. We incurred termination fees of $2.3 which were recorded in other expense, net in the Consolidated Statements of Income. For

the year ended December 31, 2013, the net impact of the gain amortization was $26.1. The interest-rate swap agreements were terminated

in order to improve our capital structure, including increasing our ratio of fixed-rate debt. At December 31, 2013, the unamortized deferred

gain associated with the January 2013 interest-rate swap termination was $64.3, and was included within long-term debt in the

Consolidated Balance Sheets.

In March 2012, we terminated two of our interest-rate swap agreements designated as fair value hedges, with notional amounts totaling

$350. As of the interest-rate swap agreements’ termination date, the aggregate favorable adjustment to the carrying value (deferred gain)

of our debt was $46.1, which is being amortized as a reduction to interest expense over the remaining term of the underlying debt

obligations through March 2019. We incurred termination fees of $2.5 which were recorded in other expense, net in the Consolidated

Statements of Income. For the years ended December 31, 2013 and 2012, the net impact of the gain amortization was $6.0 and $4.4,

respectively. The interest-rate swap agreements were terminated in order to increase our ratio of fixed-rate debt. At December 31, 2013, the

unamortized deferred gain associated with the March 2012 interest-rate swap termination was $35.7, and was included within long-term

debt in the Consolidated Balance Sheets.

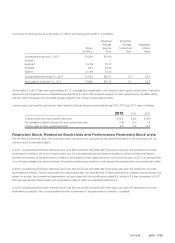

At December 31, 2013, we do not have interest-rate swap agreements designated as fair value hedges. In addition to the terminations

discussed above, the remaining interest-rate swap agreements designated as fair value hedges were terminated in conjunction with the

repayment of the associated debt. The unrealized gain on these agreements was $93.1 at December 31, 2012, of which $90.3 was included

within long-term debt and $2.8 was included within debt maturing within one year. During 2013 and 2012, we recorded net losses of $.7

and $8.4, respectively, in interest expense in the Consolidated Statements of Income for these interest-rate swap agreements designated as

fair value hedges. The impact on interest expense of these interest-rate swap agreements was offset by an equal and offsetting impact in

interest expense on our fixed-rate debt.

A V O N 2013 F-27