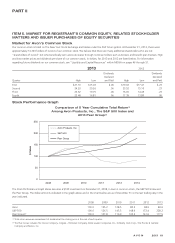

Avon 2013 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2013 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PART II

Overview

We are a global manufacturer and marketer of beauty and related products. Our business is conducted worldwide, primarily in the direct-

selling channel. We presently have sales operations in 62 countries and territories, including the United States (“U.S.”), and distribute

products in 43 more. Our reportable segments are based on geographic operations and include commercial business units in Latin America;

Europe, Middle East & Africa; North America; and Asia Pacific. Our product categories are Beauty and Fashion & Home. Beauty consists of

color, fragrance, skincare and personal care. Fashion & Home consists of fashion jewelry, watches, apparel, footwear, accessories, gift and

decorative products, housewares, entertainment and leisure products, children’s products and nutritional products. Sales are made to the

ultimate consumer principally through direct selling by more than 6 million active independent Representatives, who are independent

contractors and not our employees. The success of our business is highly dependent on recruiting, retaining and servicing our

Representatives. During 2013, approximately 88% of our consolidated revenue was derived from operations outside the U.S.

In the first quarter of 2013, we renamed our “Growth in Active Representatives” performance metric to be referred to as “Change in Active

Representatives.” In addition, we revised the definition of this metric to exclude China. As previously disclosed, our business in China is

predominantly retail, and as a result, we do not believe including China within the Change in Active Representatives calculation provides for

a relevant indicator of underlying business trends. There were no changes to the underlying calculation other than the exclusion of China.

Total revenue in 2013 compared to 2012 declined 6% compared to the prior-year period, partially due to unfavorable foreign exchange.

Constant $ revenue declined 1%, as a 2% decrease in Active Representatives was partially offset by a 1% increase in average order. Sales

from the Beauty category decreased 7%, or 2% on a Constant $ basis. Sales from the Fashion category decreased 7%, or 4% on a

Constant $ basis. Sales from the Home category increased 3%, or 9% on a Constant $ basis.

Our Constant $ revenue was impacted by net declines in North America and Asia Pacific; however, these declines were partially offset by

improvements in Latin America and Europe, Middle East & Africa. Growth in Latin America was driven by Brazil, particularly in Fashion &

Home, and Venezuela primarily due to inflationary pricing, which was partially offset by executional challenges in Mexico in the second half

of 2013. In Europe, Middle East & Africa, growth was driven by South Africa, Russia and Turkey, which was partially offset by a revenue

decline in the United Kingdom. North America experienced deteriorating financial results, primarily as a result of the decline in Active

Representatives. Asia Pacific’s revenue decline was primarily due to continuing weak performance of our China operations and operational

challenges in the Philippines.

See “Segment Review” of this Management’s Discussion and Analysis of Financial Condition and Results of Operations, which we refer to in

this report as “MD&A,” for additional information related to changes in revenue by category and segment.

We are focused on driving profitable growth by improving access to our brands and products. In order to achieve this growth, we intend to

strengthen and leverage our direct sales core, maximize our geographic portfolio and expand our brands and channels. Our revenue

recovery is taking longer than expected, and it will take some time to reverse the trends that have caused the recent deceleration. This is

partially attributed to not executing consistently on two important processes, commercial marketing (which includes pricing, merchandising

and brochure execution) and field management (which includes Representative recruitment, retention and activity), across some of our key

markets in 2013. In addition, we expect pressure on operating margin in the first half of 2014, partially as a result of gross margin in Europe,

Middle East & Africa, including the negative impact of foreign exchange.

In 2012, we announced a cost savings initiative (the “$400M Cost Savings Initiative”), in an effort to stabilize the business and return Avon

to sustainable growth, which is expected to be achieved through restructuring actions as well as other cost-savings strategies that will not

result in restructuring charges. The $400M Cost Savings Initiative is designed to reduce our operating expenses as a percentage of total

revenue to help us achieve a targeted low double-digit operating margin by 2016. The restructuring actions under the $400M Cost Savings

Initiative primarily consist of global headcount reductions and related actions, as well as the restructuring or closure of certain smaller,

under-performing markets, including our exit from the South Korea, Vietnam and Republic of Ireland markets.

As a result of the actions approved to-date, we have recorded total costs to implement these restructuring initiatives of $119.1 before taxes,

of which $68.4 before taxes was recorded in 2013. For the actions approved to-date, we expect our total costs to implement restructuring

to be in the range of $140 to $150 before taxes. The additional charges not yet incurred associated with the actions approved to-date of

approximately $20 to $30 before taxes are expected to be recorded primarily in 2014. At this time we are unable to quantify the total costs

to implement these restructuring initiatives that will be incurred through the time the initiative is fully implemented. In connection with the