Avon 2013 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2013 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

offer bid agreement between AIO and Devon Holdings K.K., an affiliate of TPG Capital (“Buyer”). Avon Japan was previously reported

within our Asia Pacific segment. The transaction closed on December 29, 2010. Of the total cash consideration of $90 received, $81 was

recognized in December 2010, with the remaining $9 of the consideration received related to certain pre-paid royalties. This transaction

resulted in a net after-tax gain of $10; however, in 2011, we determined that the net after-tax gain on sale of Avon Japan should have been

reported as a net after-tax loss of $3, to correctly include all balances relating to Avon Japan that were previously included in AOCI. See Note

1, Description of the Business and Summary of Significant Accounting Policies, for further information.

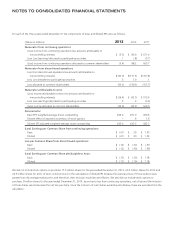

NOTE 4. Inventories

Inventories at December 31 consisted of the following:

2013 2012

Raw materials $ 310.4 $ 393.4

Finished goods 695.2 707.7

Total $1,005.6 $1,101.1

NOTE 5. Debt and Other Financing

Debt

Debt at December 31 consisted of the following:

2013 2012

Debt maturing within one year:

Notes payable $ 159.4 $ 180.6

Current portion of long-term debt 28.6 391.4

Total $ 188.0 $ 572.0

Long-term debt:

4.80% Notes, due March 2013 $ – $ 250.0

4.625% Notes, due May 2013 – 124.0

5.625% Notes, due March 2014 – 499.4

Term Loan, 25% due June 2014 and remainder due

June 2015 52.5 550.0

2.60% Senior Notes, Series A, due November 2015 – 142.0

2.375% Notes, due March 2016 249.9 –

5.75% Notes, due March 2018 249.6 249.6

4.20% Notes, due July 2018 249.6 249.6

6.50% Notes, due March 2019 347.7 347.3

Other debt, payable through 2019 with interest from

.9% to 7.2% 67.9 75.5

4.60% Notes, due March 2020 499.3 –

4.03% Senior Notes, Series B, due November 2020 – 290.0

4.18% Senior Notes, Series C, due November 2022 – 103.0

5.00% Notes, due March 2023 495.5 –

6.95% Notes, due March 2043 249.3 –

Total 2,461.3 2,880.4

Adjustments for debt with fair value hedges – 93.1

Amortization of swap termination 100.0 41.7

Less current portion (28.6) (391.4)

Total long-term debt $2,532.7 $2,623.8

A V O N 2013 F-17