Avon 2013 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2013 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

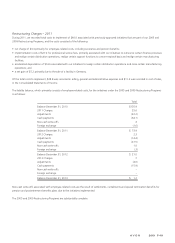

Q3 2012 China Impairment Assessment

Based on the continued decline in revenue performance in China during the third quarter of 2012 and a corresponding lowering of our

long-term growth estimates in China, we completed an interim impairment assessment of the fair value of goodwill related to our

operations in China. The changes to our long-term growth estimates were based on the state of our China business, as the China business

did not achieve our revenue, earnings and cash flows expectations primarily due to challenges in our business model. Based upon this

interim analysis, we determined that the goodwill related to our operations in China was impaired. Specifically, the results of our interim

impairment test indicated the estimated fair value of our China reporting unit was less than its respective carrying amount. As a result of our

impairment testing, we recorded a non-cash impairment charge of $44.0 ($44.0 after tax) to reduce the carrying amount of goodwill for

China to its estimated fair value.

Key Assumptions – China

Key assumptions used in measuring the fair value of China during these impairment assessments included projections of revenue and the

resulting cash flows, as well as the discount rate (based on the weighted-average cost of capital). To estimate the fair value of China, we

forecasted revenue and the resulting cash flows over ten years using a DCF model which included a terminal value at the end of the

projection period. We believed that a ten-year period was a reasonable amount of time in order to return China’s cash flows to normalized,

sustainable levels.

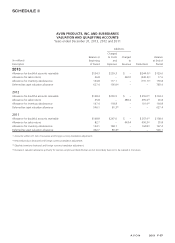

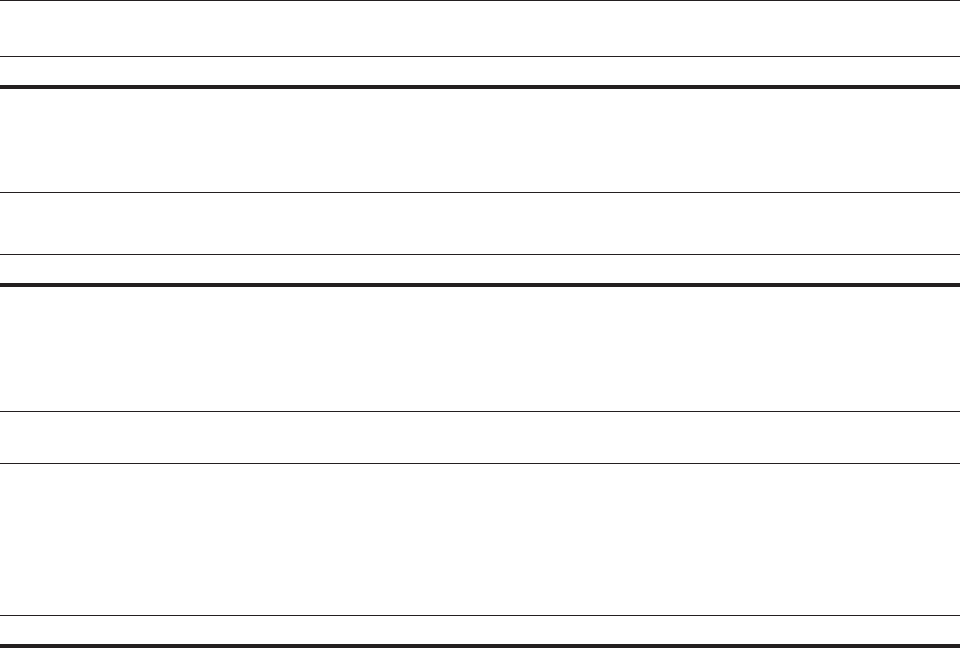

Goodwill

Latin

America

Europe,

Middle East

& Africa

Asia

Pacific Total

Gross balance at December 31, 2012 $122.8 $167.3 $ 84.2 $374.3

Accumulated impairments – – (44.0) (44.0)

Net balance at December 31, 2012 $122.8 $167.3 $ 40.2 $330.3

Changes during the period ended December 31, 2013:

Impairment $ – $ – $(38.4) $ (38.4)

Other(1) (10.2) – .8 (9.4)

Gross balance at December 31, 2013 $112.6 $167.3 $ 85.0 $364.9

Accumulated impairments – – (82.4) (82.4)

Net balance at December 31, 2013 $112.6 $167.3 $ 2.6 $282.5

(1) Other is primarily comprised of foreign currency translation.

Other intangible assets

2013 2012

Gross

Amount

Accumulated

Amortization

Gross

Amount

Accumulated

Amortization

Finite-Lived Intangible Assets

Customer relationships $ 39.9 $ (36.5) $ 52.7 $ (46.0)

Licensing agreements 52.3 (47.3) 62.8 (53.6)

Noncompete agreements 8.1 (8.1) 8.6 (8.6)

Trademarks 6.6 (6.6) 6.6 (6.3)

Indefinite-Lived Trademarks 25.1 – 24.4 –

Total $ 132.0 $ (98.5) $ 155.1 $(114.5)

Actual amortization expense may differ from the amounts above due to, among other things, future acquisitions, disposals, impairments,

accelerated amortization or fluctuations in foreign currency exchange rates. The aggregate amortization expense was $4.4, $9.5 and $6.7

for the years ended December 31, 2013, 2012 and 2011, respectively. Amortization expense in future periods is not expected to be material.

A V O N 2013 F-53