Avon 2013 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2013 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Selling, General and Administrative Expenses

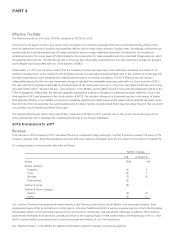

Selling, general and administrative expenses for 2013 decreased $176.1 compared to 2012. This decrease is primarily due to the favorable

impact of foreign exchange, lower professional and related fees associated with the FCPA investigation and compliance reviews, and lower

advertising costs, partially offset by a non-cash impairment charge of $117.2 for capitalized software related to SMT, which was recorded

during the fourth quarter of 2013, the $89 accrual for the potential settlements related to the FCPA investigations, higher CTI restructuring

and higher distribution costs. See Note 15, Restructuring Initiatives, on pages F-45 through F-49 of our 2013 Annual Report for more

information on CTI restructuring and Note 1, Description of the Business and Summary of Significant Accounting Policies on pages F-8

through F-14 of our 2013 Annual Report for more information on SMT.

As a percentage of revenue, selling, general and administrative expenses increased 160 basis points, while Adjusted selling, general and

administrative expenses was relatively unchanged compared to 2012. The primary drivers of Adjusted selling, general and administrative

expenses as a percentage of revenue as compared to the prior year were the following:

• an increase of 30 basis points due to higher distribution costs, driven by increased transportation costs, primarily in Latin America, and

increased costs per unit as a result of lower volume in North America;

• an increase of 20 basis points due to the unfavorable impact of foreign exchange;

• a decrease of 20 basis points from lower administrative expenses, primarily due to lower professional and related fees associated with the

FCPA investigation and compliance reviews, as well as lower compensation costs; and

• a decrease of 20 basis points from lower net brochure costs, primarily in Europe and North America, partially driven by initiatives to reduce

the cost of our brochures.

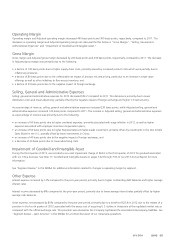

Impairment of Goodwill and Intangible Asset

During the third quarter of 2013, we recorded a non-cash impairment charge of $42.1 for goodwill and intangible assets, as compared to a

non-cash impairment charge of $44.0 in the third quarter of 2012 for goodwill, both associated with our China business. See Note 17,

Goodwill and Intangible Assets on pages F-52 through F-53 of our 2013 Annual Report for more information.

See “Segment Review” in this MD&A for additional information related to changes in operating margin by segment.

Other Expense

Interest expense increased by 16% compared to the prior-year period, primarily due to higher average interest rates partially offset by lower

outstanding debt balances.

Loss on extinguishment of debt in 2013 is comprised of $71 for the make-whole premium and the write-off of debt issuance costs

associated with the prepayment of our Private Notes (defined below) and $2 for the write-off of debt issuance costs associated with the

early repayment of $380 of the outstanding principal amount of the term loan agreement, which occurred in the first quarter of 2013. In

addition, in the second quarter of 2013 we recorded a loss on extinguishment of debt of $13 for the make-whole premium and write-off of

debt issuance costs, partially offset by a deferred gain associated with the termination of interest-rate swap agreements, associated with the

prepayment of our 2014 Notes (defined below). See Note 5, Debt and Other Financing on pages F-17 through F-21 of our 2013 Annual

Report, and “Liquidity and Capital Resources” in this MD&A for more information.

Interest income increased by 72% compared to the prior-year period, primarily impacted by the benefit of $12 for interest income

recognized in the fourth quarter of 2013, due to an out-of-period adjustment related to judicial deposits in Brazil. This out-of-period benefit

to interest income was partially offset by lower average interest rates, as well as lower average cash balances in 2013 as compared to 2012.

Other expense, net increased compared to the prior-year period, primarily due to a $34 negative impact in the first quarter of 2013 from the

devaluation of the Venezuelan currency on monetary assets and liabilities in conjunction with highly inflationary accounting. In addition,

other expense, net was impacted by the benefit of $23.8 in 2012 due to the release of a provision in the fourth quarter of 2012 associated

with the excess cost of acquiring U.S. dollars in Venezuela at the regulated market rate as compared with the official exchange rate. This

provision was released as the Company capitalized the associated intercompany liabilities. See “Segment Review – Latin America” in this

MD&A for a further discussion of our Venezuela operations.

A V O N 2013 33