Avon 2013 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2013 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

price equal to 101% of their aggregate principal amount plus accrued and unpaid interest in the event of a change in control involving Avon

and a corresponding credit ratings downgrade to below investment grade. In addition, the indenture governing the Notes contains interest

rate adjustment provisions depending on our credit ratings.

Commercial Paper Program

We also maintain a $1 billion commercial paper program, which is supported by the revolving credit facility. Under this program, we may

issue from time to time unsecured promissory notes in the commercial paper market in private placements exempt from registration under

federal and state securities laws, for a cumulative face amount not to exceed $1 billion outstanding at any one time and with maturities not

exceeding 270 days from the date of issue. The commercial paper short-term notes issued under the program are not redeemable prior to

maturity and are not subject to voluntary prepayment. Outstanding commercial paper effectively reduces the amount available for

borrowing under the revolving credit facility. Beginning in 2012 and continuing through 2013, the demand for our commercial paper

declined, partially impacted by the rating agency actions described below. We have not had significant borrowings of commercial paper in

2013, and as of December 31, 2013, there was no outstanding commercial paper under this program.

Letters of Credit

At December 31, 2013 and December 31, 2012, we also had letters of credit outstanding totaling $19.9 and $21.4, respectively, which

primarily guarantee various insurance activities. In addition, we had outstanding letters of credit for trade activities and commercial

commitments executed in the ordinary course of business, such as purchase orders for normal replenishment of inventory levels.

Additional Information

Our long-term credit ratings are Baa3 (Stable Outlook) with Moody’s and BBB- (Negative Outlook) with S&P, which are on the low end of

investment grade, and BB (Negative Outlook) with Fitch, which is below investment grade. In February 2013, Fitch lowered their long-term

credit rating from BBB- (Negative Outlook) to BB+ (Stable Outlook) and Moody’s lowered their long-term credit rating from Baa1 (Negative

Outlook) to Baa2 (Stable Outlook). In November 2013, Fitch lowered their long-term credit rating from BB+ (Stable Outlook) to BB (Negative

Outlook) and Moody’s placed Avon’s long-term credit rating of Baa2 (Stable Outlook) on review for possible downgrade. In February 2014,

Moody’s lowered their long-term credit rating from Baa2 (Stable Outlook) to Baa3 (Stable Outlook). Additional rating agency reviews could

result in a further change in outlook or downgrade, which could limit our access to new financing, particularly short-term financing, reduce

our flexibility with respect to working capital needs, affect the market price of some or all of our outstanding debt securities, as well as most

likely result in an increase in financing costs, including interest expense under certain of our debt instruments, and less favorable covenants

and financial terms of our financing arrangements.

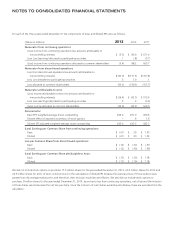

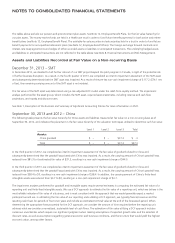

NOTE 6. Accumulated Other Comprehensive Loss

The tables below present the changes in AOCI by component and the reclassifications out of AOCI during 2013:

Foreign

Currency

Translation

Adjustments

Cash Flow

Hedges

Net

Investment

Hedges

Pension and

Postretirement

Benefits Total

Balance at December 31, 2012 $(317.6) $(6.8) $(4.3) $(548.0) $(876.7)

Other comprehensive loss other than reclassifications (111.7) – – – (111.7)

Reclassifications into earnings:

Derivative losses on cash flow hedges, net of tax of $.9(1) – 1.7 – – 1.7

Adjustments of and amortization of net actuarial loss

and prior service cost, net of tax of $55.7(2) – – – 116.3 116.3

Total reclassifications into earnings – 1.7 – 116.3 118.0

Balance at December 31, 2013 $(429.3) $(5.1) $(4.3) $(431.7) $(870.4)

(1) Gross amount reclassified to interest expense, and related taxes reclassified to income taxes.

(2) Gross amount reclassified to pension and postretirement expense, within selling, general & administrative expenses, and related taxes reclassified to income

taxes.

A V O N 2013 F-21