Avon 2013 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2013 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

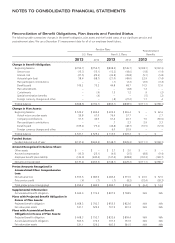

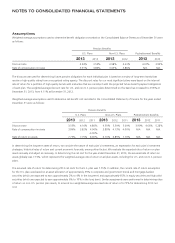

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

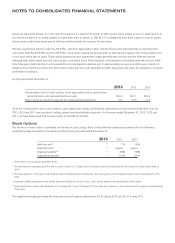

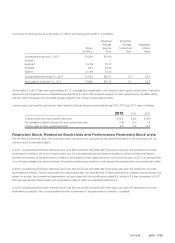

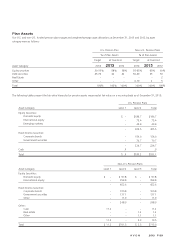

A summary of restricted stock and restricted stock units at December 31, 2013, and changes during 2013, is as follows:

Restricted

Stock

And Units

(in 000’s)

Weighted-

Average

Grant-Date

Fair Value

January 1, 2013 3,467 $23.18

Granted 2,323 20.36

Vested (1,004) 27.91

Forfeited (552) 22.03

December 31, 2013 4,234 $20.67

A summary of performance restricted stock units at December 31, 2013, and changes during 2013, is as follows:

Performance

Restricted

Stock Units

(in 000’s)

Weighted-

Average

Grant-Date

Fair Value

January 1, 2013(1) 2,909 $22.19

Granted 1,977 20.17

Vested – –

Forfeited (503) 21.34

December 31, 2013(1) 4,383 $22.19

(1) Based on initial target payout.

The total fair value of restricted stock units that vested during 2013 was $19.4, based upon market prices on the vesting dates. At

December 31, 2013, there was approximately $64.4 of unrecognized compensation cost related to restricted stock, restricted stock units

and performance restricted stock units compensation arrangements. That cost is expected to be recognized over a weighted-average period

of 2.0 years.

In addition to the amounts in the table above, in April 2012 we granted 200,000 restricted stock units that will be funded with treasury

shares, outside of the 2010 Plan, in reliance upon The New York Stock Exchange rules. These restricted stock units have a weighted-average

grant-date fair value of $21.69 and vest and settle ratably over five years. During 2013, 40,000 of these restricted stock units vested, and

160,000 of these restricted stock units were outstanding at December 31, 2013. During 2013 and 2012, we recognized compensation cost

of $1.4 and $1.4, respectively, for these restricted stock units. At December 31, 2013, there was $1.6 of unrecognized compensation cost

related to these restricted stock units.

NOTE 11. Stock Repurchase Program

In October 2007, our Board of Directors approved a five-year $2,000.0 share repurchase program (“$2.0 billion program”) which began in

December 2007. The program expired on December 17, 2012. We repurchased approximately 4.8 million shares for $180.8 under the $2.0

billion program through its expiration.

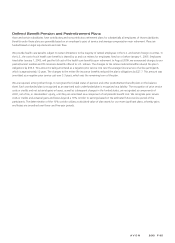

NOTE 12. Employee Benefit Plans

Savings Plan

We offer a qualified defined contribution plan for U.S.-based employees, the Avon Personal Savings Account Plan (the “PSA”), which allows

eligible participants to contribute up to 25% of eligible compensation through payroll deductions. We match employee contributions dollar

for dollar up to the first 3% of eligible compensation and fifty cents for each dollar contributed from 4% to 6% of eligible compensation.

We made matching contributions in cash to the PSA of $10.6 in 2013, $11.8 in 2012 and $12.6 in 2011, which were then used by the PSA

to purchase our shares in the open market through June 30, 2011. Beginning July 1, 2011, matching contributions follow the same

allocation that the participant has selected for his or her own contributions.