Avon 2013 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2013 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

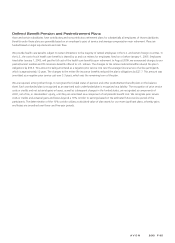

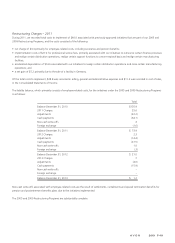

Postemployment Benefits

We provide postemployment benefits, which include salary continuation, severance benefits, disability benefits and continuation of health

care benefits to eligible former employees after employment but before retirement. The accrued cost for postemployment benefits was

$39.1 at December 31, 2013 and $52.2 at December 31, 2012, and was included in employee benefit plans in the Consolidated Balance

Sheets.

Supplemental Retirement Programs

We offer a non-qualified deferred compensation plan, the Avon Products, Inc. Deferred Compensation Plan (the “DCP”), for certain higher

paid key employees. The DCP is an unfunded, unsecured plan for which obligations are paid to participants out of our general assets. The

DCP allows for the deferral of up to 50% of a participant’s base salary, the deferral of up to 100% of incentive compensation bonuses, the

deferral of performance restricted stock units for certain employees (through the end of 2012 only), and the deferral of contributions that

would normally have been made to the PSA but are not deferred because the amount was in excess of U.S. Internal Revenue Code limits on

contributions to the PSA. Participants may elect to have their deferred compensation invested in one or more of three investment

alternatives. Expense associated with the DCP was $1.2 in 2013, $1.7 in 2012 and $1.4 in 2011. The accrued liability for the DCP was $57.9

at December 31, 2013 and $69.7 at December 31, 2012 and was included in other liabilities in the Consolidated Balance Sheets.

We maintain supplemental retirement programs consisting of the Supplemental Executive Retirement Plan of Avon Products, Inc. (“SERP”)

and the Benefit Restoration Pension Plan of Avon Products, Inc. under which non-qualified supplemental pension benefits are paid to higher

paid key employees in addition to amounts received under our qualified retirement plan, which is subject to IRS limitations on covered

compensation. The annual cost of these programs has been included in the determination of the net periodic benefit cost shown previously

and amounted to $7.6 in 2013, $8.4 in 2012 and $9.8 in 2011.

The benefit obligation under these programs was $44.2 at December 31, 2013 and $63.9 at December 31, 2012 and was included in

employee benefit plans and accrued compensation in the Consolidated Balance Sheets.

We also maintain a Supplemental Life Plan (“SLIP”) under which additional death benefits ranging from $.4 to $2.0 are provided to certain

active and retired officers. The SLIP has not been offered to new officers since January 1, 2010.

We established a grantor trust to provide assets that may be used for the benefits payable under the SERP and SLIP. The trust is irrevocable

and, although subject to creditors’ claims, assets contributed to the trust can only be used to pay such benefits with certain exceptions. The

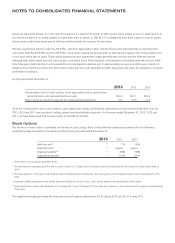

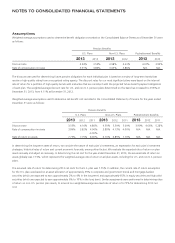

assets held in the trust are included in other assets and at December 31 consisted of the following:

2013 2012

Corporate-owned life insurance policies $ 30.5 $ 42.7

Cash and cash equivalents .8 (.1)

Total $ 31.3 $ 42.6

The assets are recorded at fair market value, except for investments in corporate-owned life insurance policies which are recorded at their

cash surrender values as of each balance sheet date, which is a proxy of fair value. Changes in the cash surrender value during the period are

recorded as a gain or loss within selling, general and administrative expenses in the Consolidated Statements of Income.

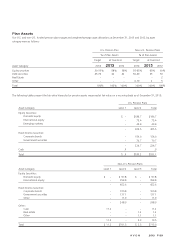

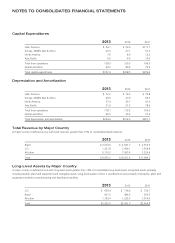

NOTE 13. Segment Information

Our reportable segments are based on geographic operations and include commercial business units in Latin America; Europe, Middle East &

Africa; North America; and Asia Pacific. The segments have similar business characteristics and each offers similar products through similar

customer access methods.

In the second quarter of 2013, Silpada was classified within discontinued operations. See Note 3, Discontinued Operations for more

information. Accordingly, all amounts exclude the results of Silpada for all periods presented.