Avon 2013 Annual Report Download - page 121

Download and view the complete annual report

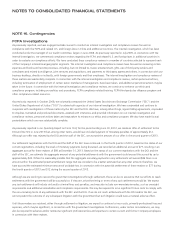

Please find page 121 of the 2013 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Litigation Matters

In July and August 2010, derivative actions were filed in state court against certain present or former officers and/or directors of the

Company (Carol J. Parker, derivatively on behalf of Avon Products, Inc. v. W. Don Cornwell, et al. and Avon Products, Inc. as nominal

defendant (filed in the New York Supreme Court, Nassau County, Index No. 600570/2010); Lynne Schwartz, derivatively on behalf of Avon

Products, Inc. v. Andrea Jung, et al. and Avon Products, Inc. as nominal defendant (filed in the New York Supreme Court, New York County,

Index No. 651304/2010)). On November 22, 2013, a derivative action was filed in federal court against certain present or former officers

and/or directors of the Company (Sylvia Pritika, derivatively on behalf of Avon Products, Inc. v. Ann S. Moore, et al. and Avon Products, Inc.

as nominal defendant (filed in the United States District Court for the Southern District of New York, No. 13-CV-8369)). The claims asserted

in one or more of these actions include alleged breach of fiduciary duty, abuse of control, waste of corporate assets, and unjust enrichment,

relating to the Company’s compliance with the FCPA, including the adequacy of the Company’s internal controls. The relief sought against

the individual defendants in one or more of these derivative actions include certain declaratory and equitable relief, restitution, damages,

exemplary damages and interest. The Company is a nominal defendant, and no relief is sought against the Company itself. In the Parker

case, plaintiff has agreed that defendants’ time to file an answer, motion to dismiss or other response is adjourned until plaintiff files an

amended pleading. In Schwartz, the parties have agreed to defer the filing of an amended complaint and the defendants’ response thereto

until the parties submit a further stipulation addressing the scheduling of proceedings. In Pritika, the parties have agreed to a stipulated

schedule for the filing of a motion to dismiss on behalf of the defendants. We are unable to predict the outcome of these matters.

On May 14, 2012, County of York Retirement Plan (“County of York”) – which had been a plaintiff in a previously-filed but now

discontinued derivative action – filed a complaint against the Company seeking enforcement of its demands for the inspection of certain of

the Company’s books and records (County of York Retirement Plan v. Avon Products, Inc., New York Supreme Court, New York County,

Index No. 651673/2012). On July 10, 2012, the Company moved to dismiss County of York’s complaint. On November 21, 2013, the Court

approved County of York’s stipulation of voluntary discontinuance without prejudice.

On July 6, 2011, a purported shareholder’s class action complaint (City of Brockton Retirement System v. Avon Products, Inc., et al.,

No. 11-CIV-4665) was filed in the United States District Court for the Southern District of New York against certain present or former

officers and/or directors of the Company. On September 29, 2011, the Court appointed LBBW Asset Management Investmentgesellschaft

mbH and SGSS Deutschland Kapitalanlagegesellschaft mbH as lead plaintiffs and Motley Rice LLC as lead counsel. Lead plaintiffs have filed

an amended complaint on behalf of a purported class consisting of all persons or entities who purchased or otherwise acquired shares of

Avon’s common stock from July 31, 2006 through and including October 26, 2011. The amended complaint names the Company and two

individual defendants and asserts violations of Sections 10(b) and 20(a) of the Exchange Act based on allegedly false or misleading

statements and omissions with respect to, among other things, the Company’s compliance with the FCPA, including the adequacy of the

Company’s internal controls. Plaintiffs seek compensatory damages as well as injunctive relief. Defendants moved to dismiss the amended

complaint on June 14, 2012. We are unable to predict the outcome of this matter. However, it is reasonably possible that we may incur a

loss in connection with this matter. We are unable to reasonably estimate the amount or range of such reasonably possible loss.

Under some circumstances, any losses incurred in connection with adverse outcomes in the litigation matters described above could be

material.

Brazilian Tax Matters

In 2002, our Brazilian subsidiary received an excise tax (IPI) assessment from the Brazilian tax authorities for alleged tax deficiencies during

the years 1997-1998. In December 2012, additional assessments were received for the year 2008 with respect to excise tax (IPI) and taxes

charged on gross receipts (PIS and COFINS), totaling approximately $355, $53 and $245 each, including penalties and accrued interest, at

the exchange rate on December 31, 2013. The 2002 and the 2012 assessments assert that the establishment in 1995 of separate

manufacturing and distribution companies in that country was done without a valid business purpose and that Avon Brazil did not observe

minimum pricing rules to define the taxable basis of excise tax. The structure adopted in 1995 is comparable to that used by many other

companies in Brazil. We believe that our Brazilian corporate structure is appropriate, both operationally and legally, and that the 2002 and

2012 assessments are unfounded.

These matters are being vigorously contested. In January 2013, we filed a protest seeking a first administrative level review with respect to

the 2012 assessments. In July 2013, the 2012 IPI assessment was upheld at the first administrative level and we have appealed this decision

to the second administrative level. In October 2013, the 2012 PIS and COFINS assessments were canceled in our favor by the first

administrative level. This decision will be subject to a mandatory appeal to the second administrative level by the Brazilian tax authorities. In

A V O N 2013 F-51