Avon 2013 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2013 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

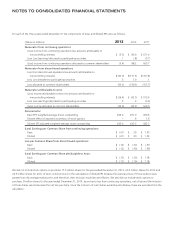

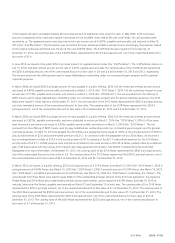

Capitalized Software

Certain systems development costs related to the purchase, development and installation of computer software are capitalized and

amortized over the estimated useful life of the related project, generally not to exceed five years. Costs incurred prior to the development

stage, as well as maintenance, training costs, and general and administrative expenses are expensed as incurred. The other assets balance

included unamortized capitalized software costs of $122.9 at December 31, 2013 and $235.4 at December 31, 2012. The amortization

expense associated with capitalized software was $55.4, $41.2 and $41.1 for the years ended December 31, 2013, 2012 and 2011,

respectively, and we recorded a capitalized software impairment charge of $117.2 during 2013.

Capitalized software is reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount may not be

fully recoverable. If such a change in circumstances occurs, the related estimated future pre-tax undiscounted cash flows expected to result

from the use of the asset and its eventual disposition are compared to the carrying amount. If the sum of the expected cash flows is less

than the carrying amount, an impairment charge is recorded. The impairment charge is measured as the amount by which the carrying

amount exceeds the fair value of the asset. The fair value of the asset is determined using revenue and cash flow projections, and royalty

and discount rates, as appropriate.

In December 2013, we decided to halt further roll-out of our Service Model Transformation (“SMT”) project. SMT was a global program

initiated in 2009 to improve our order management system and enable changes to the way Representatives interact with us. SMT was

piloted in Canada during 2013, and caused significant business disruption in that market. This decision to halt the further roll-out of SMT

was made in light of the potential risk of further disruption. In addition, SMT did not show a clear return on investment. Our current focus is

on stabilizing and growing the Avon business and improving operating capability, which includes updating information technology

infrastructure in a way that delivers clear return on investment.

We currently expect to continue to utilize the capitalized software associated with SMT (“SMT asset”) in the pilot market of Canada. As

Canada will be the only market using the SMT asset, the accounting guidance requires the impairment assessment to consider the cash

flows of the Canadian business, which includes the ongoing costs associated with SMT. These expected cash flows are not sufficient to

supporting the carrying value of the associated asset group, which includes the SMT asset. In the fourth quarter of 2013, we recorded a pre-

tax non-cash impairment charge of $117.2 ($74.1 net of tax), reflecting the write-down of capitalized software. This impairment charge was

recorded as a component of our global expenses, within selling, general and administrative expenses in the Consolidated Statements of

Income.

The fair value of the SMT asset was determined using a risk-adjusted discounted cash flow (“DCF”) model under the relief-from-royalty

method. The impairment analysis performed for the asset group, which includes the SMT asset, required several estimates, including revenue

and cash flow projections, and royalty and discount rates. As a result of this impairment charge, the remaining carrying amount of the SMT

asset is not material.

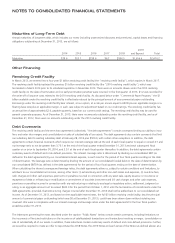

Goodwill and Intangible Assets

Goodwill is not amortized and is assessed for impairment annually during the fourth quarter or on the occurrence of an event that indicates

impairment may have occurred, at the reporting unit level. A reporting unit is the operating segment, or a component, which is one level

below that operating segment. Components are aggregated as a single reporting unit if they have similar economic characteristics. When

testing goodwill for impairment, we perform either a qualitative or quantitative assessment for each of our reporting units. Factors

considered in the qualitative analysis include macroeconomic conditions, industry and market considerations, cost factors and overall

financial performance specific to the reporting unit. If the qualitative analysis results in a more likely than not probability of impairment, the

first quantitative step, as described below, is required.

The quantitative test to evaluate goodwill for impairment is a two-step process. In the first step, we compare the fair value of a reporting

unit to its carrying value. If the fair value of a reporting unit is less than its carrying value, we perform a second step to determine the implied

fair value of the reporting unit’s goodwill. The second step of the impairment analysis requires a valuation of a reporting unit’s tangible and

intangible assets and liabilities in a manner similar to the allocation of the purchase price in a business combination. If the resulting implied

fair value of the reporting unit’s goodwill is less than its carrying value, that difference represents an impairment.

The impairment analysis performed for goodwill requires several estimates in computing the estimated fair value of a reporting unit. We use

a DCF approach to estimate the fair value of a reporting unit, which we believe is the most reliable indicator of fair value of this business,