Avon 2013 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2013 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Private Notes

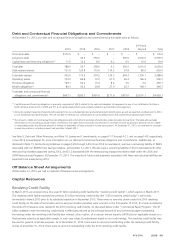

On November 23, 2010, we issued, in a private placement exempt from registration under the Securities Act of 1933, as amended, $142.0

principal amount of 2.60% Senior Notes, Series A, due November 23, 2015, $290.0 principal amount of 4.03% Senior Notes, Series B, due

November 23, 2020, and $103.0 principal amount of 4.18% Senior Notes, Series C, due November 23, 2022 (collectively, the “Private

Notes”). The proceeds from the sale of the Private Notes were used to repay existing debt and for general corporate purposes.

On March 29, 2013, we prepaid our Private Notes. The prepayment price was equal to 100% of the principal amount of $535.0, plus

accrued interest of $6.9 and a make-whole premium of $68.0. In connection with the prepayment of our Private Notes, we incurred a loss

on extinguishment of debt of $71.4 in the first quarter of 2013, which included the make-whole premium and the write-off of $3.4 of debt

issuance costs related to the Private Notes.

Public Notes

In May and June 2003, respectively, we issued, in public offerings, $250.0 principal amount of 4.20% Notes, due July 15, 2018 and $125.0

principal amount of 4.625% Notes, due May 15, 2013. In March 2008, we issued, in a public offering, $250.0 principal amount of 4.80%

Notes, due March 1, 2013 and $250.0 principal amount of 5.75% Notes, due March 1, 2018. In March 2009, we issued, in a public

offering, $500.0 principal amount of 5.625% Notes, due March 1, 2014 (the “2014 Notes”) and $350.0 principal amount of 6.50% Notes,

due March 1, 2019. The net proceeds from these offerings were used to repay indebtedness outstanding under our commercial paper

program and for general corporate purposes.

The 4.80% Notes due March 1, 2013 were repaid in full at maturity. On April 15, 2013 we prepaid the 2014 Notes at a prepayment price

equal to 100% of the principal amount of $500.0, plus accrued interest of $3.4 and a make-whole premium of $21.7. In connection with

the prepayment of our 2014 Notes, we incurred a loss on extinguishment of debt of $13.0 in the second quarter of 2013 consisting of the

$21.7 make-whole premium for the 2014 Notes and the write-off of $1.1 of debt issuance costs and discounts related to the initial issuance

of the 2014 Notes, partially offset by a deferred gain of $9.8 associated with the January 2013 interest-rate swap agreement termination.

See Note 8, Financial Instruments and Risk Management on pages F-26 through F-29 of our 2013 Annual Report for more information. In

addition, the 4.625% Notes due May 15, 2013 were repaid in full at maturity.

In March 2013, we issued, in a public offering, $250.0 principal amount of 2.375% Notes, due March 15, 2016, $500.0 principal amount of

4.60% Notes, due March 15, 2020, $500.0 principal amount of 5.00% Notes, due March 15, 2023 and $250.0 principal amount of 6.95%

Notes, due March 15, 2043 (collectively, the “Notes”). The net proceeds from these Notes were used to repay $380.0 of the outstanding

principal amount of the term loan agreement, to prepay the Private Notes and 2014 Notes (plus make-whole premium and accrued interest),

and to repay the 4.625% Notes, due May 15, 2013 at maturity. Interest on the Notes is payable semi-annually on March 15 and

September 15 of each year.

Commercial Paper Program

We also maintain a $1 billion commercial paper program, which is supported by the revolving credit facility. Under this program, we may

issue from time to time unsecured promissory notes in the commercial paper market in private placements exempt from registration under

federal and state securities laws, for a cumulative face amount not to exceed $1 billion outstanding at any one time and with maturities not

exceeding 270 days from the date of issue. The commercial paper short-term notes issued under the program are not redeemable prior to

maturity and are not subject to voluntary prepayment. Outstanding commercial paper effectively reduces the amount available for

borrowing under the revolving credit facility. Beginning in 2012 and continuing through 2013, the demand for our commercial paper

declined, partially impacted by the rating agency actions described below. We have not had significant borrowings of commercial paper in

2013, and as of December 31, 2013, there was no outstanding commercial paper under this program.

Additional Information

Our long-term credit ratings are Baa3 (Stable Outlook) with Moody’s and BBB- (Negative Outlook) with S&P, which are on the low end of

investment grade, and BB (Negative Outlook) with Fitch, which is below investment grade. In February 2013, Fitch lowered their long-term

credit rating from BBB- (Negative Outlook) to BB+ (Stable Outlook) and Moody’s lowered their long-term credit rating from Baa1 (Negative

Outlook) to Baa2 (Stable Outlook). In November 2013, Fitch lowered their long-term credit rating from BB+ (Stable Outlook) to BB (Negative

Outlook) and Moody’s placed Avon’s long-term credit rating of Baa2 (Stable Outlook) on review for possible downgrade. In February 2014,

Moody’s lowered their long-term credit rating from Baa2 (Stable Outlook) to Baa3 (Stable Outlook). Additional rating agency reviews could

result in a further change in outlook or downgrade, which could limit our access to new financing, particularly short-term financing, reduce

A V O N 2013 51