Avon 2013 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2013 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

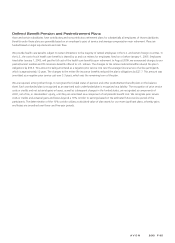

The overall objective of our U.S. pension plan is to provide the means to pay benefits to participants and their beneficiaries in the amounts

and at the times called for by the plan. This is expected to be achieved through the investment of our contributions and other trust assets

and by utilizing investment policies designed to achieve adequate funding over a reasonable period of time.

Beginning in 2014, our investment strategy for the U.S. pension plan is designed to match the movements in the pension liability through an

increased allocation towards debt securities. In addition, we will also utilize derivative instruments to achieve the desired market exposures or

to hedge certain risks.

Pension trust assets are invested so as to achieve a return on investment, based on levels of liquidity and investment risk that are prudent

and reasonable as circumstances change from time to time. While we recognize the importance of the preservation of capital, we also

adhere to the theory of capital market pricing which maintains that varying degrees of investment risk should be rewarded with

compensating returns. Consequently, prudent risk-taking is justifiable.

The asset allocation decision includes consideration of the non-investment aspects of the Avon Products, Inc. Personal Retirement Account

Plan, including future retirements, lump-sum elections, growth in the number of participants, company contributions, and cash flow. These

characteristics of the plan place certain demands upon the level, risk, and required growth of trust assets. We regularly conduct analyses of

the plan’s current and likely future financial status by forecasting assets, liabilities, benefits and company contributions over time. In so

doing, the impact of alternative investment policies upon the plan’s financial status is measured and an asset mix which balances asset

returns and risk is selected.

Our decision with regard to asset mix is reviewed periodically. Asset mix guidelines include target allocations and permissible ranges for each

asset category. Assets are monitored on an ongoing basis and rebalanced as required to maintain an asset mix within the permissible ranges.

The guidelines will change from time to time, based on an ongoing evaluation of the plan’s tolerance of investment risk.

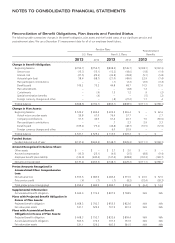

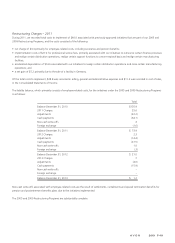

Cash flows

We expect to make contributions in the range of $50 to $55 to our U.S. pension and postretirement plans and in the range of $30 to $35 to

our international pension and postretirement plans during 2014.

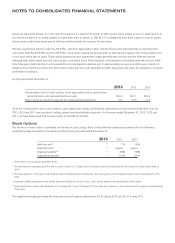

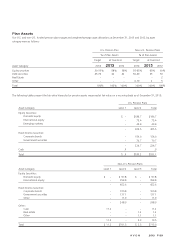

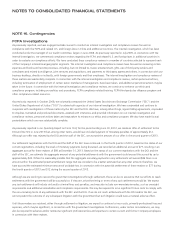

Total benefit payments expected to be paid from the plans are as follows:

Pension Benefits

U.S. Plans

Non-U.S.

Plans Total

Postretirement

Benefits

2014 $162.9 $ 40.0 $202.9 $ 8.8

2015 82.2 43.9 126.1 8.6

2016 61.7 45.0 106.7 8.5

2017 58.1 47.0 105.1 8.5

2018 53.5 49.4 102.9 8.4

2019-2023 239.5 284.7 524.2 39.8

Postretirement Benefits

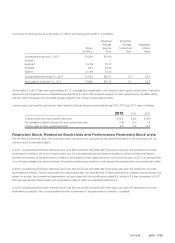

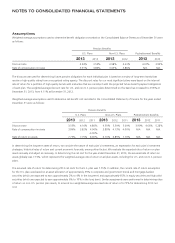

For 2013, the assumed rate of future increases in the per capita cost of health care benefits (the health care cost trend rate) was 9.2% for all

claims and is assumed to gradually decrease each year thereafter to 5.0% (in 2022 and beyond for our U.S. plan). A one-percentage point

change in the assumed health care cost trend rates for all postretirement plans would have the following effects:

1 Percentage

Point Increase

1 Percentage

Point Decrease

Effect on total of service and interest cost components $ .2 $ (.2)

Effect on postretirement benefit obligation 2.0 (1.9)

A V O N 2013 F-41