Avon 2013 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2013 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

At December 31, 2013, we had tax loss carryforwards of $2,519.8. The loss carryforwards expiring between 2014 and 2028 are $197.2 and

the loss carryforwards which do not expire are $2,322.6. We also had minimum tax credit carryforwards of $37.9 which do not expire,

business credit carryforwards of $15.3 that will expire between 2020 and 2033, and foreign tax credit carryforwards of $585.4 that will

expire between 2018 and 2023.

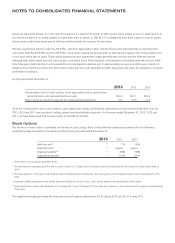

Uncertain Tax Positions

At December 31, 2013, we had $28.0 of total gross unrecognized tax benefits of which approximately $2.8 would impact the effective tax

rate, if recognized.

A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows:

Balance at December 31, 2010 $ 84.3

Additions based on tax positions related to the current year 1.2

Additions for tax positions of prior years 9.3

Reductions for tax positions of prior years (20.0)

Reductions due to lapse of statute of limitations (6.7)

Reductions due to settlements with tax authorities (32.1)

Balance at December 31, 2011 36.0

Additions based on tax positions related to the current year 7.4

Additions for tax positions of prior years 9.3

Reductions for tax positions of prior years (3.7)

Reductions due to lapse of statute of limitations (6.4)

Reductions due to settlements with tax authorities (6.6)

Balance at December 31, 2012 36.0

Additions based on tax positions related to the current year 5.3

Additions for tax positions of prior years 1.9

Reductions for tax positions of prior years (7.8)

Reductions due to lapse of statute of limitations (3.1)

Reductions due to settlements with tax authorities (4.3)

Balance at December 31, 2013 $ 28.0

We recognize interest and penalties accrued related to unrecognized tax benefits in the provision for income taxes. We had $4.4 at

December 31, 2013 and $6.2 at December 31, 2012, accrued for interest and penalties, net of tax benefit. We recorded benefits of $.1,

$1.1 and $3.8 for interest and penalties, net of taxes during 2013, 2012 and 2011, respectively.

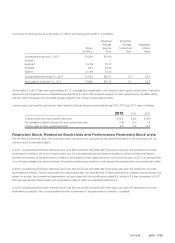

We file income tax returns in the U.S. federal jurisdiction, and various state and foreign jurisdictions. As of December 31, 2013, the tax years

that remained subject to examination by major tax jurisdiction for our most significant subsidiaries were as follows:

Jurisdiction Open Years

Brazil 2008-2013

China 2007-2013

Mexico 2008-2013

Poland 2008-2013

Russia 2011-2013

United States 2013

We anticipate that it is reasonably possible that the total amount of unrecognized tax benefits could decrease in the range of $5 to $10

within the next 12 months due to the closure of tax years by expiration of the statute of limitations and audit settlements.

A V O N 2013 F-25